HIMS: Another (Misleading) GLP-1 PR Claim

Why Andrew's recent Tweet is misleading and also, maybe self-incriminating?

Disclaimer: All information provided herein by Cedar Grove Capital Management, LLC (“Cedar Grove Capital” or “the fund”) is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in a private fund or any other security. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents.

Cedar Grove Capital may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason.

Students can get access to our research at a reduced rate by clicking here. If you’re interested in using Koyfin (I highly recommend it), you can get 20% off your plan using my link here.

Interested in becoming an LP? Click here to fill out the contact form.

If you've been following our HIMS work, you know that we value intellectual honesty when it comes to healthcare, and HIMS has not been doing the best job with that when it comes to GLP-1s.

Last year, they released their *weight loss paper*, which was just a PR/marketing report to make themselves look better from the outside for their role in prescribing compounded Semaglutide during the shortage.

At the time, not enough time had passed since their GLP-1 launch in May, but Andrew was basing their *superior* retention and outcomes just 30 days out and comparing said outcomes versus the Blue Cross Blue Shield (BCBS) BHI report.

In our report from October 30, 2024, we debunked why comparing the two was intellectually dishonest and not accurate. At face value, it made sense why HIMS picked this report because it does make them look good to the unwitting reader. However, if you dove into it like we did, it was less than convincing for the many reasons we outlined.

But that's not why we're here today. No. Today, we're here because of what Andrew posted on Twitter Thursday night (below) regarding HIMS personalized GLP-1 retention.

On Thursday, once again, Andrew claimed that HIMS personalized dosing was superior to other benchmarks for clinical adherence and retention. Boasting that after three months, the subscribers on a personalized (90,000 to be exact) had 60% clinical adherence and retention.

Sounds like a good flex, right? Wrong. It's a weird flex because it's actually bad/misleading for two reasons.

The retention rate is worse than real-world data suggests.

It appears that the personalized claim is (potentially) self-incriminating for mass prescribing.

Let's start with the first issue. Retention.

Personalized Retention

Andrew claimed that BECAUSE of their personalized dosing options, this led to better patient outcomes, which, in turn, led to better retention after 3 months.

This immediately jumped out at us because we know for a fact that it's incorrect based on data published last year.

The whole point of HIMS offering a personalized dose is to cut out the (allegedly) side effects that might prevent a patient from adhering to the drug and being on it long enough to see significant weight loss.

That's the justification for why these telehealth companies have been pushing personalized dosages: they're claiming it leads to better retention outcomes via reduced side effects. That’s it.

The problem is that Andrew's claim doesn't show that. Suppose you look at the image below, which we shared with you all in February. In that case, it shows that Andrew's superior personalization has NOT led to better outcomes vs commercially available doses (i.e., doses that are FDA-approved).

JPM shared this data on January 1st based on Gleason data shared on May 8th, 2024. The above image (LHS) highlights persistence and adherence for obese commercially insured adults without diabetes between January 1, 2021, and December 31, 2021.

As you can see above, at the three-month mark (90 days), retention for those taking Wegovy was ~70%, +1,000 bps above Andrew’s claim of 60% retention at the three-month mark.

Retention did not drop to the 60% level until ~130 days after starting the medication, which is a little after four months. Vastly different than what was claimed on HIMS side.

However, like with all our research, we identify caveats to these studies and how they’re being recorded and shared. With that, let us briefly go over why retention could be different between this study and Andrew’s claim.

First and foremost, drug adherence and retention largely revolve around a few key metrics.

Intent → Does the patient really want to get a treatment solution for their condition?

Drug efficacy → Does it even work?

Tolerance → Are the side effects manageable? This ties into #2 with efficacy because people will tolerate more if it works well.

Price → Does a combination of the drug efficacy and tolerance line well with what they’re paying to continue their treatment?

We can’t measure these with high confidence at the individual level, but via a combination, we can infer a few things.

We already know that those who have signed up to take the drug are there to lose weight. No question about that, so we can rank intent = high.

We also know that the drug works well because, on average, commercially available doses lead to ~15% weight loss for patients who take it. Drug efficacy = high.

For the tolerance, which we highlighted in our January 27th report, 2.9% of patients in the Semaglutide trial from 2022 had severe adverse effects that led to discontinuation, and in the 2024 trial, only 6.5% of patients discontinued because of severe adverse effects.

We highlighted it back then, and we’ll highlight it again now, that’s not a very high number for people who chose to stop taking it, which led to confusion at the time as to why a personalized dose was supposed to lead to inferior outcomes. So with those discontinuation rates, we can assume that tolerance = high.

Lastly, which is very important, comes down to price. How much are people paying? Now, the Gleason paper we referenced above is based on patients who had insurance, but before you’re quick to write that off, let us dig in a little.

Price can affect consumer behavior a lot, but it does get affected by the other factors we previously mentioned. If the price is too high but the drug efficacy is moderate to low, or the tolerance is too much (low tolerance), then a high price likely isn’t justified unless the intent/need is super high (i.e., think along the lines of a life-saving drug).

Vice versa, if the drug price is low but the efficacy is medium to low and tolerance is medium to low, then a patient might be able to stay on it because it’s not breaking the bank (simple illustration below).

The other factor about price, which is tied to insurance, is what the price actually is. Are these patients fully covered by insurance (i.e., no cost to them)? Is there a low monthly copay (ex, $50/mo)? Is there a large deductible? Is the copay counted towards your deductible? Many factors affect the retention at the end of the day for the study and the patients who participated in it.

We won’t know exactly for sure, but what we do know is that with this study, the price was not cash pay, meaning they weren’t paying the $499/mo that you see today or even the regular pre-NovoCare price of ~$1,400/mo, implying they had a good deal through their insurance provider.

Additionally, this study was done with commercial dosing, so there was no personalization to help with the “side effects” from the drug. With both of these factors combined, the adherence and retention rate were still higher than what Andrew claimed in his post.

The thought here is that a lower-priced cash pay option, that has arguably the highest intent because there’s no insurance coverage, combined WITH a personalized option to help with the virtually non-existent discontinuation-related side effects, would have either met or exceeded the retention rates after. But, they didn’t.

This is why we mentioned on Twitter the other day that Andrew’s post is misleading because he most likely is referencing the BHI study (which is also insurance-based) but full of flaws, and not the Gleason study that shows real-world retention that is better than what Andrew claims.

This is the reason we’re writing this post, because, once again, Andrew is highlighting claims to help HIMS with the hope that people support him and his push for personalized drugs without actually bothering to check further.

Takeaways:

Price largely dictates retention, assuming intent, efficacy, and a high tolerance to side effects are present.

A commercial dose study proved that retention at the 90-day mark is better than what Andrew described for his personalized options.

Given that cash-pay options are super high intent, because they’re paying out of pocket, you would assume that a personalized option + a lower monthly price would yield better retention figures → they haven’t based on the Gleason data.

Andrew is most likely picking a study that best serves his narrative, and thus, is better for marketing purposes.

Note: ~42% of adults with private insurance are eligible for GLP-1 coverage,1 and most covered patients pay less than $100/month.2

The Personalization Argument

We’ve talked about the personalization of Semaglutide in-depth for months at this point, so there’s no reason why we should continue beating a dead horse. If you’d like to have lawyers’ views on the matter, you can take a look at our expert calls where they’ve talked and highlighted that you cannot compound drugs in inordinate amounts, among other things.

The gist of all those conversations gets summed up into two points.

You are allowed to compound commercially available doses during a shortage, but must stop once the storage comes off. Nothing wrong with that, assuming you’re doing it legally and with the utmost safety.

Personalized (compounded) drugs are also allowed, but not regularly or in bulk quantities. Hence, personalized drugs that aren’t generic are a rarity because people en masse should have no reason to be on a personalized drug that’s on patent. It equates to IP theft when done in “inordinate amounts.”

This has been the crux of the HIMS situation because we never really knew just how many people they had on a personalized plan, but we could assume that it was a lot. The issue here is that if HIMS were mass-prescribing personalized doses, it would raise flags to the state medical boards (at the 503a level) for why they were doing this so frequently.

Funny enough, HIMS already told us that they were launching personalized Semaglutide doses for HERS as early as July 24th, 2024, which we included in our March report, and is interesting because they didn’t even launch the commercially available doses until basically the end of May 2024. Meaning, they went ahead to personalized options as little as ~1.5 months after offering the product.

Thankfully, Andrew kindly let us know that there were at least 90,000 HIMS subscribers on a personalized Semaglutide plan as part of his study. When we spoke to lawyers earlier in the year, they said that even having 50,000 subscribers on a personalized plan would be too much because how can you say that tens of thousands of people need a unique dose in order to make this drug successful for them? It’s not logical. Based on Andrew’s tweet, there’s at least 2x that amount currently on the platform.

So here’s our thoughts on that part.

Andrew and management knew that eventually the shortage would end and they would have to stop, but if they were able to get subscribers on a personalized plan as quickly as possible, then they could play into the whole “but you can’t make someone change after they’ve already had personalized drugs prescribed to them.”

This implies that Andrew and management knew what they were doing by ramping up personalized doses as early as possible to build up a sticky base that wouldn’t be required to come off once the shortage was over. At least not without a fight.

If you recall, when Yemi gave guidance earlier in the year for FY sales excluding commercial doses after Q1, we said the only way that was obtainable was if they already had a bunch of people on a personalized plan or they were going to continue prescribing personalized plans at scale (see below).

All of this brings us to our last point. Lack of enforcement. It’s no secret that many in the healthcare space have wondered why HIMS hasn’t been sued yet by the state boards, the FDA, or even Novo Nordisk. It’s a good question that we don’t have the answer to.

Regulatory-wise, we’re not surprised. Things move at a glacial pace there → see earlier in the year for getting Semaglutide off shortage.

As far as Novo Nordisk goes, that one is a worse case of confusion. Based on all the evidence, you’d think they have them dead to rights on this which made matters worse that they decided to partner with HIMS to benefit NovoCare despite the IR team explicitly saying that it’s not a partnership.

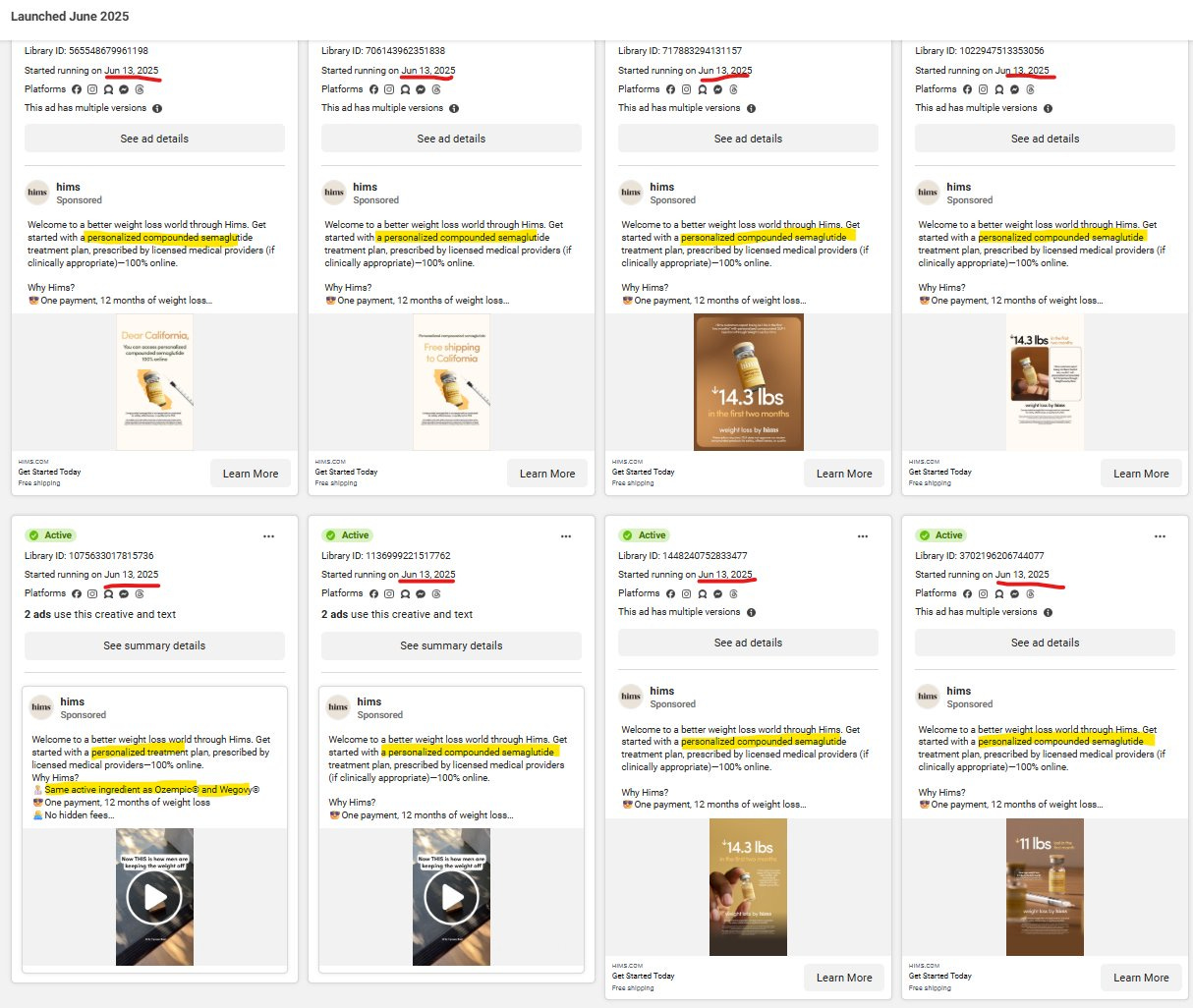

Okay….tell that to everyone other than you who’s been calling it a partnership. And as we highlighted back in our May 30th tweet thread, HIMS is actively pushing personalized options on people after they click on the Wegovy flow to side-step having to prescribe branded Wegovy (more financial benefit to HIMS) as well as actively launching ads on Meta that specifically are for personalized Semaglutide treatment plans (June 16th).

It’s VERY public that HIMS, under Andrew, thinks that they can get away with their continued push of personalized drugs, so they’ve openly paid for ads that make customers go through that flow as opposed to the Wegovy flow.

Why Novo Nordisk hasn’t acted on this, perhaps being Danish has made them too nice, but everyone knows it’s eating into their sales, making them look like a joke to investors, and their stock price is still in the tubes.

Perhaps after firing Lars (recent CEO), and Parvus Asset Management buying up a large stake to influence a new CEO selection, will wake the company up and do what they should have done already.

Until then, two things we can say with confidence.

Until Novo Nordisk wakes up and chooses to fight to defend its IP, owning that company makes no sense. Maybe shorting it is the better call, since having a fiduciary duty to their shareholders to stop companies from stealing their IP means nothing to them apparently.

Andrew is smart, and he knows how to push the boundaries just enough not to get into blatantly obvious trouble. But when it comes to the personalized plans for weight loss, until a regulator or NVO comes knocking on the door with a cease order or full-on lawsuit, he’s going to continue doing it, and the evidence is all there for everyone to see.

Time will tell, but at least Eli Lilly (LLY) has said they will not partner with anyone that continues to sell compounded GLP-1s, which is a good thing since that means they won’t be partnering with HIMS any time soon.

A slight glimmer of hope for those who are just as confused as we are.

As always, we appreciate your support of our work. If you have any questions, please make sure to message or comment below. If you think others would benefit from the research/commentary we release, we would greatly appreciate your sharing.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm