Green Thumb Industries - the Weed that Can't Stop Growing

The recent pullback in the stock amid blowout earnings release represents a strong entry point for a starter position

Summary

As predicted, Green Thumb not only met but also beat estimates on the top and bottom line, showing a clearer path of maintaining growth expectations without sacrificing profit

Ending the year with 51 stores, the company still has a total of 97 licenses they can use which means still adding a healthy 41 more stores of untapped potential (they are currently opening their 56th store come March 31st).

With new partnerships, further adoption of cannabis nationally, and increased sales per store, Green Thumb unit economics point to increased margin expansion and fatter per share profits

The other week, I wrote an article on why I thought Green Thumb Industries was going to be one of the winners in the growing cannabis market and listed out my thesis on why.

I made sure to make that post ahead of their full-year 2020 earnings release that was made on March 17th, 2021.

Earnings Recap

Long story short, they beat on both top and bottom lines, and initially, the stock popped 11% in pre-market trading to hover back at near its February high of ~$38.

Beating estimates on a top-line basis was no surprise but what was surprising was how much they beat on the bottom. Having achieved profitability 3 years after being public is no easy feat and I labeled them as a great company to get this done in my post.

2021 estimates point to an average topline estimate of $853M and a bottom-line estimate of $0.45 a share. This represents a jump of 53% and 543%, respectively.

I have no concerns that management will not be able to achieve this should no black swan events take place again. The addition of more states coming online, like New York said they might this week, will help them get there.

Average Store Sales Increase

What I also called was that the company will have to focus on increasing sales in its existing stores since eventually, they will be capped with the number of licenses they have.

This prediction seems to be true since they have consistently grown average store sales to over $2.4M and with being able to obtain $3M plus, their valuation will surely become priced in as time goes on.

The Meat and Potatoes - Potential Buying Opportunity

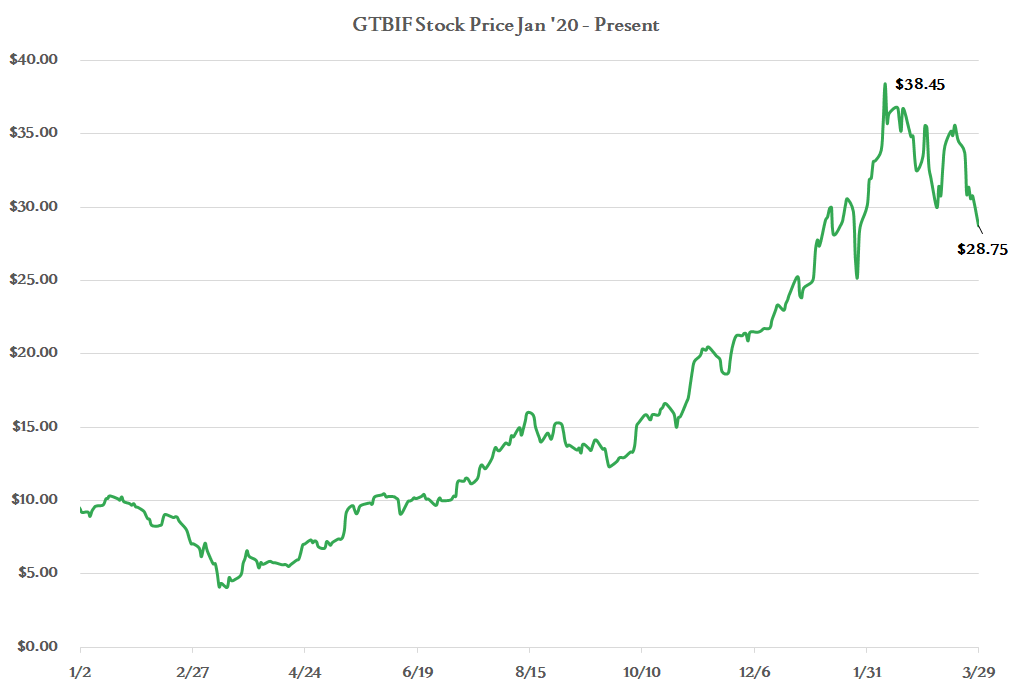

When I first made my post on Green Thumb, the stock was trading at $30.81. Post earnings, the stock slowly climbed to $37.37 on an intraday level before eventually settling today at $28.75.

This represents a drop of (25.2%) from its February highs. Now fundamentally, there is nothing wrong with this company. A lot of the market pullback has been from fears of inflation, rising rates, and to some degree, that boat that decided to halt 13% of all sea trade for a week.

Topline and bottom-line are growing rapidly and exceeding analyst estimates. More stores are being opened across the nation. They recently announced a partnership with Cann and are more importantly, profitable.

I write these articles for the sake of long-term investing. That means I do not trade in and out of a stock to capture slight gains. I would only buy in and out to adjust my price with a mentality to hold for at least 2-3 years. Green Thumb is one of those companies to me.

Operationally, they are killing the game and as per my last post, even on a multiple basis, they are trading below their peers with significant upside. Though I will never push you to invest in a stock, because you should always do your due diligence, I would highly suggest you explore taking a starter position in this company. If you already have a starter position, maybe consider expanding your stake to capture the future gains that will surely come in the next few years.

Remember, in this racket, patience and doing your homework will always outweigh trying to trade your way to the top.