IPO Notes: FLY-E Group Pricing Looking A Little Too Rich

Why I decided to pass on this micro-cap IPO

Back on March 20, 2024, I released my initial IPO notes on FLY-E Group (FLYE), a company that specializes in designing, installing, and selling smart electric motorcycles. At the time of that post, I was very interested in the company because I quite literally saw these bikes everywhere in NYC but I wanted to see how the updated S-1 stacked up and what IPO pricing suggested.

You can read my initial thoughts below — the post is not paywalled.

I really wanted this company to prove that it was a diamond in the rough of micro-cap IPOs, but unfortunately, after reading the updated S-1, I noticed that not much has changed about the business that quelled my nerves. As much as I hoped for FY’24 updates, the updated S-1 covers just the 9 months ending December 2023, giving us a smaller glimpse into how the company is doing versus the last update. Even with another quarter of financials made public, I think the IPO might be a little too rich to get involved.

Before I dive into the negatives, I want to quickly go over the positives and confirm the parts of the updated S-1 that might have had me worried if they changed.

The current ownership structure hasn’t changed much at all. The CEO and founder still owns the same 35% he did in the initial S-1 and his salary is still the same.

Wholesale sales channel as a % of total is still roughly ~20% which is good considering there’s better margin on the DTC channel.

Debt has shrunk and is still very manageable under current conditions.

The company is profitable and has increased its total product volume by 87% YoY (ending March 2024).

AOV of the bikes has marginally increased from the Sep’23 updated financials so it’s more a volume play right now vs pricing.

However, despite not getting worried about certain parts of the business, some still make me nervous.

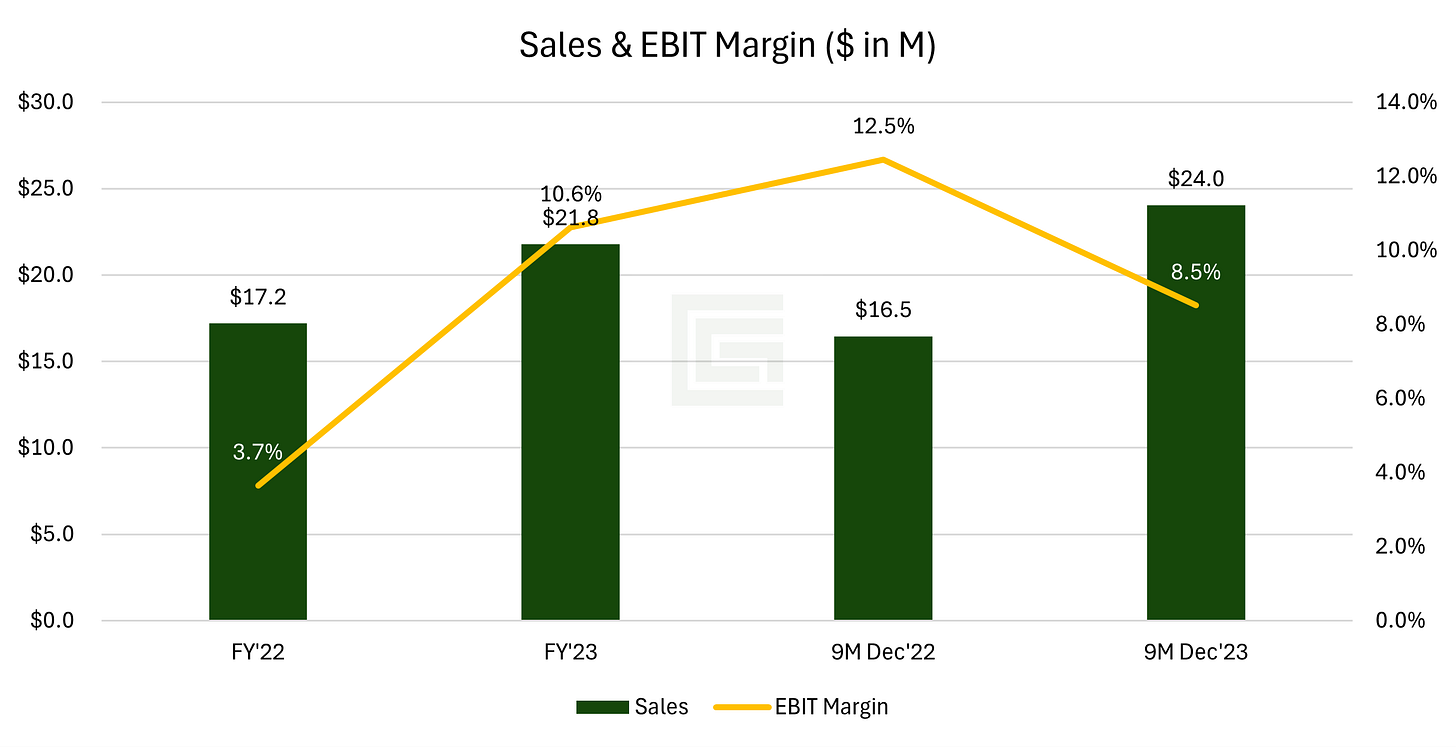

In the 9-months ending FY’24 (December 2023), FLYE has put up an impressive +46% YoY growth in topline sales but a disappointing 8.5% EBIT margin; contracting -400bps YoY.

The main cause here is the increase in Selling Expenses which as a % of revenue, increased from 15.8% to 19.3% over the same timeframe (+350bps). Management blames the increase in costs to be primarily due to the number of new stores and employees hired.

The issue that I have with this is that comparing the first 6 months of FY’24 vs the first 9 months of FY’24 shows a strong increase in expenses in just 3 months.

While I don’t know the exact store count at the end of 2023, I do know that when I went through store by store on their website for the original research, the overall number hadn’t changed much. While I can’t definitively prove that there was a meaningful change in store count during that time, I’m skeptical to believe the company just opened up new stores heavily once the winter season started.

While topline is still growing at an impressive rate, I get nervous about the margin contraction and the exposure that it has in its customer base. While no customer represents >10% of its sales in 2024, that doesn’t mean it’s not catered to a certain type of customer.

Calling out my fear directly from the S-1.

“The majority of our customers are food delivery workers in New York City. This group constitutes approximately 70% of our customer base for the year ended March 31, 2023.”

I’m going to assume that that figure hasn’t changed much in the most recent year. While I see these bikes everywhere in the city and I purposely look at the brand of every bike I come across (they mostly all happen to be FLYE), it makes me nervous that this company seems to really only sell to 1 market: delivery drivers.

While their financial results speak for themselves, the thought of underwriting a micro-cap company that’s driving most of its growth from food delivery drivers gives me pause.

If you expect the market to slow down or even become saturated in key urban markets, the topline growth figure can quickly stall out. Even with management controlling most of the shares both before and after IPO (76.5% vs 67.3% post-IPO), the worry is too much.

Even with fundamental business risks that I believe are justified, let’s look at IPO pricing.

Right now, the company is looking to sell 3,000,000 shares (25,000,000 in total post-IPO) between $3.00 and $5.00 and potentially raise ~$8 million to ~$13.5 million (net of fees) without the greenshoe.

Looking at what that could look like on a multiple basis, have a look below.

From an LTM basis, which is my assumption, we’re talking nearly 3.0x EV/sales and 30x LTM EBITDA at the midpoint. For a micro-cap company that’s doing “well” but under real risks like the customer base and lack of growth in other urban cities at the moment, I can’t get comfortable with it as much as I want to.

If you’re in the New York City area, have a look at your delivery driver’s wheels and see if you recognize the brand. I’m sure you will.

As for now, I wish Andy (CEO and Co-Founder) the best but I’ll watch from the sidelines. This will be another name in micro-cap land that I’m going to pass on.

If you think otherwise, shoot me a message or comment below.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm