Fiverr: Why the Freelance Economy is Here to Stay

Fiverr (FVRR) flourished during the pandemic, but it helped set the stage for how companies pay for work

Summary

The company is benefitting from an organic shift into freelance work caused by the pandemic

Improving margins across the board will help the company achieve profitability much sooner than expected

Fiverr is incorporating new ways to build up it’s revenue streams with different offerings

Freelance work, as a whole, is becoming more widely accepted from a business and worker lense

Business Overview

Fiverr International Ltd FVRR 0.00%↑ is an Israel-based company that operates an online marketplace worldwide. Its platform connects businesses with freelancers offering digital services in more than 200 categories, across more than seven verticals including graphic design, digital marketing, programming, video, and animation.

Its buyers include businesses of various sizes, as well as sellers, who comprise a group of freelancers and small businesses. The Company’s global community of freelancers spans across more than 160 countries.

As of December 31, 2020, the company has served 3.4 million active buyers compared to 2.4 million in 2019.

Prices can range from $5 to thousands of dollars, depending on the scope and perceived quality of each individual Gig. The way they make money is just by taking a cut of the price that sellers charge buyers.

Business Performance

Stock Price Performance

Fiverr has been around for a little while but what really kicked off the stock was actually the pandemic. Before COVID, when the economy was still roaring in all aspects, freelance work had just started to gain steam but was adopted in mass. However, once the pandemic hit and many were left unemployed or looking for supplemental income, Fiverr’s platform was one of the spaces that they turned to.

Since January of last year, the stock hit a closing all-time high on February 12th of $323.10 and has since receded to the ~$170 mark. A 47% drop from its recent 52 week high.

Financial Performance

Looking at 2020 compared to 2019, the company did very well. Laid out below are key stats that are worth noting

Revenue grew +77% to $189mm vs. $107mm the prior year

Gross margin increased 330 bps to 82.5%

Adj. EBITDA grew to $9.1mm vs. -$18mm the prior year

Net Income loss as a percent of sales decreased from -31.3% to -7.8%

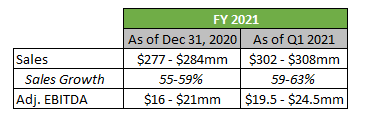

Forward Guidance as of December 31, 2020

Sales: $277 - $284mm

Sales Growth: 46-50%

ADj. EBITDA: $16 - $21mm

Investment Thesis

I’ve been a fan of Fiverr for a while now, both as a buyer of services but also as a seller. It’s really a good way to make some side money if you just want an extra few bucks in your pocket on top of your day job. They offer a wide variety of service categories that can fit any and almost all needs of business owners and are adding new ones all the time.

When COVID came about last year, and unemployment reached a peak of 14.7% in April and many did not know how they were to provide for themselves or their families. Many turned to freelance work with many turning to sites such as Fiverr to earn some money while the pandemic ran its course.

This was also a time when many figured that they should take this “downtime” to do something productive for themselves. Things like starting your own business, learning a new trade, or how to cook etc.

According to Oberlo, the number of small businesses actually increased by over 1 million in 2020 to 31.7 million.

With a continued entrepreneurial spirit in the air and existing companies looking to freelance work for projects instead of having to hire full-time workers, Fiverr is poised to be the continued leader in the freelance marketplace space.

Let’s dive into some catalysts and some very positive trends.

The health of the overall business is improving

One of the main reasons why everyone loves tech companies is because of their lower or non-existent cost of goods sold, aka COGs. COGs eat into your margins the more capital intensive your business is, however, if you’re a tech company then theoretically you have little to no COGs to put into an end product. This potential “savings” can then be applied to other expenses like hiring top-quality talent (SG&A) or better yet, putting it to use in your marketing budget.

For Fiverr, their product is their online talent marketplace and this allows them to have very high gross margins.

Since it went public back in 2019, Fiverr has been improving its business while growing exponentially, though they aren’t profitable just yet.

Since 2018, the company has:

Increased gross margins by 320 bps to 82.5%

Significantly decreased their marketing as a percent of sales by 1,400 bps to 24.1%

Decreased their SG&A as a percent of sales from 65.9% to 49.8%

Decreased their operating loss from -48.3% to -6.2%

Decreased their net income loss from -47.8% to -7.8%

and lastly, improved adjusted EBITDA margins from -16.8% to +4.8%

Management is doing an excellent job optimizing paid marketing and acquisition costs. The company labels their customer payback as tROI (time to return on investment) and aims to have it at one year or less. This is the spot of what their breakeven point is based on paid marketing. In the last 8 quarters ending December 31st, 2020, they achieved tROI in six months or less.

Also, the amount of operating leverage that the company has to pull on is very high which is great if things for some reason get tough.

Though COVID-19 really sped things up for a lot of companies, I believe that the heavy introduction to freelance work from both the buyer and seller perspectives has introduced a new normal for hiring great talent for projects. I do not think that this trend will slow down in a post-pandemic world but will normalize over time and still provide an uplift in long-term topline growth.

More and more people are turning to freelance work to earn money

The number of freelancers in the United States has continued to grow as more look to either change up the way they make their money or just to earn some on the side. Please note however that this figure is representative of all gig workers and not just those that could apply to Fiverr’s platform.

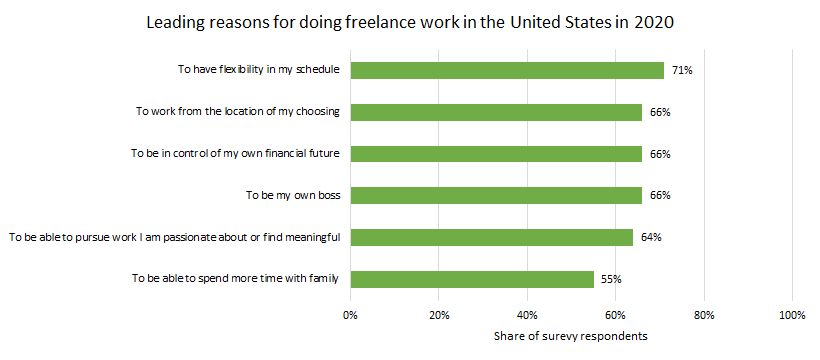

Either way, people want to make extra money. What’s interesting though is why they are. The chart below from the same Statista report

Benefits to workers these days have proved to be right up there with how much they are paid. Whether you are looking at the boomer generation, millennials, or even the newly market entering generation Z, work benefits matter.

Over 70% of respondents wanted the flexibility to make their own schedule and there was a three-way tie at 66% based on geography, being in control of their financial future, and being their own boss. This is not a temporary trend and I believe it will only grow from here, which will help expand Fiverr’s TAM and the fees that can be generated from it.

One last chart that I want to show is just the shift of workers as well.

These figures only support my rationale of the way freelance work is perceived with over 30% of people making it their full-time job.

It’s also reassuring when you get a glance at these headlines from publications that boast just how much money these freelance workers are making for themselves.

7 steps I took to create an attractive profile on Upwork and make $400,000 as a freelance designer

Average spend per buyer increasing

When you think about how a marketplace can scale topline growth, it’s usually in a few ways.

Charge more, i.e. take a larger cut of the pie (usually doesn't bode well with your base)

Increase the number of people on the platform that conduct transactions

Get more people to spend more, on average

Point three is very similar to the consumer world under what is called “AOV” (average order value). Essentially, have each person spend more on average. This is where Fiverr is excelling at, on top of other things.

The company has seen its average spend per buyer (ASB) increase from $64 in 2012 to over $200 as of 2020. Management believes this is a combination of a few things.

Increasing the number of categories and gigs through sheer number and complexity has allowed for a more dynamic approach to having business services fulfilled.

Their machine learning technology doesn’t just focus on what buyers currently need but also their future needs building on top of their existing orders.

They also are moving upmarket to attract buyers that can contribute to a higher LTV.

What is interesting too is that for the year ended December 31, 2020, buyers who spent over $500 accounted for over 58% of their core marketplace revenue, up from 53% in the year ended December 31, 2019.

The more buyers are spending on average, coupled with a lower payback period will help with margin expansion and top-line growth.

Expansion and new growth opportunities

The name of the game for Fiverr is being able to offer a wide variety of services to attract more buyers to their platform and spend more money to increase LTV. At the end of 2020, the company added an additional 30 categories bringing the overall total past 500.

What’s more interesting is that since then, they’ve launched a 9th vertical to expand into data-related services but also launched two new revenue-generating businesses, subscriptions, and milestones.

Subscriptions

The company has introduced a new way to get repeat business from buyers to increase recurring revenue to the seller and better yet, the company. The service is called subscriptions.

It’s simple to use and the buyer can set a three or six-month cadence for work and even offer discounts because of this recurring service. According to the most recent quarter commentary, the company has expanded subscription categories to 25, up from 8 in Q4’20.

This business unit is in its infancy but in time, management believes it can become a sizeable portion of total revenue.

Milestones

Milestones is a feature that allows you to create stepping stones when working on a bigger project (worth >$50) with a buyer. It ensures that you will receive payment for the tasks you completed during the project.

Milestones also allow buyers to establish trust and confidence in your services and work in steps to ensure satisfaction.

Many buyers don’t like using freelance workers because they feel that their work product might be lackluster, possible theft of IP, and any other concerns a company might have for a non-directly employed worker.

Milestones not only make sure that tasks get paid as they are completed but more importantly, make businesses feel more comfortable with freelance work in general. Making businesses feel more comfortable with using freelance work only helps the underlying business as it grows and now can bring on more buyers at a faster rate.

This is more of an adoption aspect for the business that I’m bullish about.

Raising guidance

Not that this is a catalyst, but it’s still nice to see happen as it reinforces management’s expectations that they are going to have a strong financial year. Below I’ve made a quick chart of what 2021 guidance was as of December 2020 and what it was after announcing Q1 earnings.

Valuation

Fiverr’s valuation is hard to quantify in traditional ways. There aren’t that many companies that are comparable to Fiverr on a core business model way except for Upwork UPWK 0.00%↑ and other “fee” based marketplace companies that are more mature in nature like eBay EBAY 0.00%↑, Paypal PYPL 0.00%↑, or other growth names like Etsy ETSY 0.00%↑ and Poshmark POSH 0.00%↑.

Though I never look at them, besides to figure things out directionally, below I’ve included analyst estimates as a reference point.

6 BUY ratings

2 HOLD ratings

Price Target:

High - $335

Median - $252

Low - $180

Average - $254

Going off the median price of $252, that is a +48.5% upside as of Friday’s close.

Conclusion

This is one of my more “growth” names but it still engrains itself on the thematic play of the gig economy. What Fiverr has going for it compared to other growth names is all that I listed above.

A large and growing global market

Rapid topline growth and expanding margins

A clear path to profitability

New and innovative ways to continue building various revenue streams

With the recent market selloff over the last few weeks, the current price as an entry point has become very attractive.

I think Fiverr is a great growth name to own for the long run and isn’t one of the more questionable names currently gaining large amounts of CNBC airtime.

*The current stock price at the time of this article: $167.50