"Diamonds Are Forever. Even If They're Grown."

The rise and growing popularity of lab-grown diamonds

Diamonds have recently gathered a lot of headline attention because of the rate and popularity of lab-grown diamonds.

Simply put, lab-grown diamonds are, as the name suggests, created and grown in a lab, unlike their mined counterparts, which are found hundreds of miles underneath the Earth's surface.

"What takes the earth millions of years to grow, can now be achieved in a matter of weeks."

Having gained much attention over the last few weeks, lab-grown diamonds have actually been around since the 90’s. While it is visually, chemically, and physically identical to a natural diamond, lab-created diamonds can cost up to 85% less and are considered a more sustainable option than mined diamonds.

A three-carat mined diamond ring, for example, might be $30,000 but $14,000 using lab-grown. And, as more jewelry brands release their own lab-grown lines, some customers’ concerns about the pieces not being “real” diamonds have dissipated.

But this isn’t the first time that mined diamonds have fallen out of fashion and there’s a very interesting marketing turnaround that brought back the “specialty” of diamonds.

Rewinding a bit to the 1930s, it was a bad decade for the diamond industry – the price of diamonds had declined worldwide, Europe was on the verge of another war and the idea of a diamond engagement ring didn’t take hold.

At the time, engagement rings were considered a luxury and when given, they rarely contained diamonds. In 1938, De Beers engaged N.W. Ayer & So – the first advertising agency in the United States – to change the image of diamonds in America.

The ad agency suggested a clever ad campaign to link diamonds to romance in the public’s mind.

To do this, they placed diamonds on the fingers of Hollywood stars and suggested stories to newspapers on how diamond rings symbolized romance.

The ad agency even targeted high school students, by outlining a subtle program that included arranging for lecturers to visit high schools across the country. The lectures revolved around diamond engagement rings and reached thousands of girls in their assemblies and classes.

In 1946, the agency organized a weekly service called ‘Hollywood Personalities’ which provided 125 leading newspapers with descriptions of the diamonds recently worn by Hollywood stars, as well as wives and daughters of political leaders – creating prestigious role models for the poorer, middle-class members of society.

In 1948, an N.W. Ayer copywriter named Frances Gerety, had a flash of inspiration and came up with the slogan “A Diamond is Forever” – a fitting slogan that reminds people that a diamond is a memorial to love, and as such, must stay forever in the family, never to be sold. Ironically, Gerety never married and died a spinster.

Equating diamonds with romance wasn’t enough and toward the end of the 1950s, N.W. Ayer found that the Americans were ready for the next logical step – making a diamond ring a necessary element in betrothal.

Since the agency first linked diamonds to romance in the late 1930s, a new generation of young people had grown to a marriageable age, and they’d been taught that a diamond ring was a necessity when it came to engagements – to the extent that those who couldn’t afford one at the time of their marriage, would defer their purchase rather than forgo it.

Of course, the agency was clever and managed to take things one step further. After noticing that women were involved in the selection of their engagement ring and had a tendency to pick cheaper rings, De Beers introduced the surprise element, which would see a man pick the diamond on their own – pushing the message that the more expensive the stone, the better they’ll look in the eyes of their partner.

Even a set of guidelines was provided for men – differing by nation, they stated that American men should spend two months of their salary on an engagement ring, whereas men in the United Kingdom should spend one month and those in Japan should spend three months.

Was it really the most brilliant advertising campaign of all time, you ask? Well in 1939, when De Beers engaged N.W. Ayer to change the way the American public viewed diamonds, its annual sales of the gem were $23 million.

By 1979, the ad agency had helped De Beers expand its sales to more than $2.1 billion.

But this isn’t the point of this post. This post is focused on mined diamonds growing foe, the “lab-grown” diamond.

The Rise of Lab-Grown

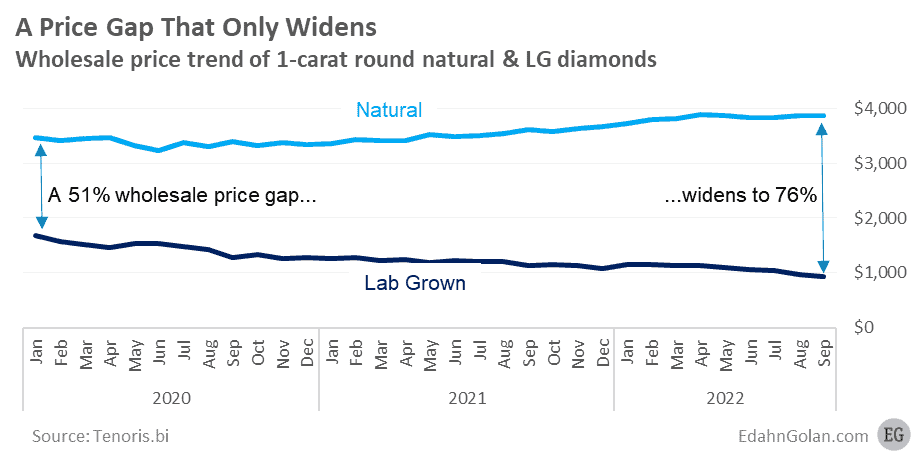

The lab-grown diamond market has taken off in the past 5-7 years. Factors such as rapid decline in prices, increasing consumer awareness, and rising disposable income are expected to drive the overall market growth in the forecasted period.

About half of global consumer demand for diamonds is from the US. In 2022, an unusual year, it was more than 50%. About 22% of all jewelry sales by US jewelry retailers are sales of loose diamonds.

While jewelers don’t sell loose diamonds as loose, they buy loose diamonds and set them in jewelry.

From a diamond industry perspective, selling loose diamonds to retailers, as opposed to selling to jewelry manufacturers, is an exceptionally important sales channel, and not only because of the considerable volume. This is the main sales channel for the larger, better, and pricier diamonds.

In value, this 22% share was worth about $8.6 billion in annual sales to consumers in the US in 2022.

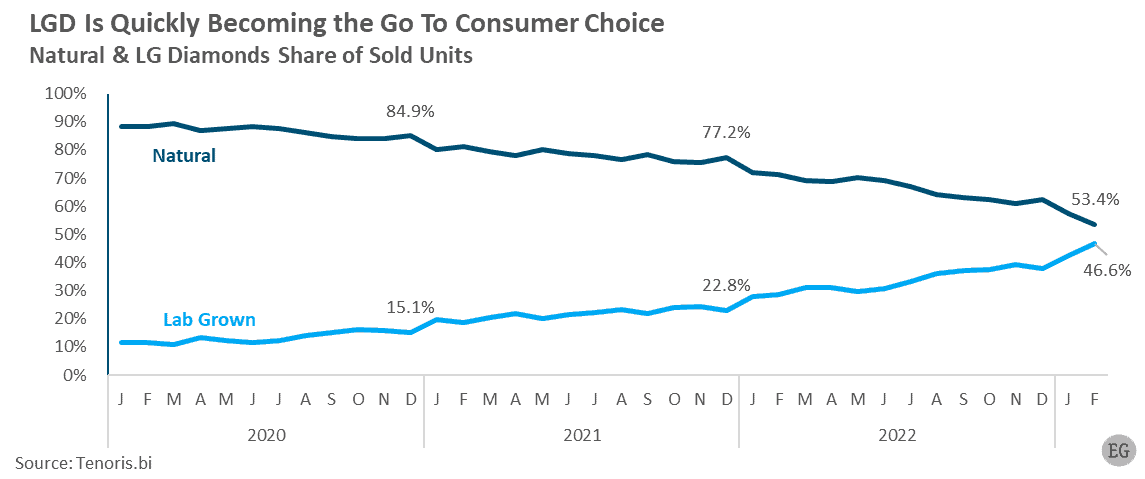

By value, the share of loose lab-grown diamonds doubled from an average of 8.3% in 2020 to 17.3% in 2022. To get a better perspective on the rapid change and its trend, the value share of loose lab-grown diamonds tripled from 7.2% in January 2020 to 22.9% this past February.

While the share of sales by value is tricky to predict, unit sales are considerably easier.

Loose lab-grown diamond unit sales held a share of 13.7% in 2020. That was viewed as relatively high at the time. Since then, their share has only increased, nearly tripling to 33.8% in 2022.

That is a rapid rate. The incredible part is the steep rise from an 11.6% share in January 2020 to a remarkable 46.6% this past February. In just three years, we moved from just a tenth of sales to nearly half.

There are other areas where lab-grown diamonds are especially dominant, and in some cases, have already captured a 50% market share.

Some pockets of activity may escape notice. One such pocket hides among diamond engagement rings, no less.

The share of diamond engagement rings set with lab-grown diamonds is constantly increasing. Out of total diamond engagement ring sales, 17.3% were set with lab-grown diamonds in February 2023. This is a significant increase from the 1.7% share they had three years ago.

The typical diamond engagement ring, one set with a natural diamond, would historically contain a one-carat diamond. If the purchased ring comes set with a diamond, it will usually be a little smaller, around 0.85 carats. When a couple buys a ring and picks the diamond, it tends to be a diamond larger than one carat.

As stated, with loose diamonds representing 22% of specialty jewelers’ jewelry sales, the larger diamonds are a significant part of their business activity.

When examining consumer demand for engagement rings set with lab-grown diamonds, we find that 50% is no longer a future scenario.

In January of this year, sales were evenly split 50/50 between natural and lab-grown diamonds.

If you follow lab-grown diamond sales this is not completely surprising. The average size of sold lab-grown diamonds is only growing.

Issues With Lab-Grown

Despite the growing popularity of lab-grown diamonds, I do see some issues with them when you zoom out and look at the market from a 50,000-foot view.

#1 Scarcity

Lab-grown diamonds are man-made diamonds that are created in a laboratory or factory. The technology is new, “cutting edge,” and expensive – at the moment.

But something to consider is that – historically, all new technology starts out being expensive, and then becomes more streamlined and then gets very inexpensive. That means that, in the future, lab-grown diamonds might be very inexpensive – which means the value of ones purchased today will also plummet.

Plus, lab-grown diamonds are not finite like their natural counterparts, so there is no guarantee that they will hold any value in the future because their supply will always be high.

#2 Authenticity

Deciding what is real and what’s fake these days is very important when it comes to consumers. This has been a hot topic of debate when it comes to “fake news” and opposing views.

However, nationwide surveys show that the vast majority of women still want natural diamonds. In a 2018 survey by the Diamond Producers Association (DPA) and The Harris Poll, only 16 percent of women claimed that they believed lab-grown diamonds were “real” diamonds.

The allure of diamonds has always been that they are an amazing, natural product of the earth that took millions of years to form. That appeal is lost when they are mass-produced in a laboratory, or worse – a factory.

#3 Appraisals

Just as some grading labs have started offering certification for lab-grown diamonds, jewelry appraisers will also appraise them—as they would any natural diamond—in line with their current market value.

Yes, your appraisal might say “lab-grown” on it. That’s what it is. But you have to take into account that an appraisal isn’t the value of your diamond, or what you paid for it. It’s meant to evaluate the cost of replacing it, for insurance purposes.

So you still could be “saving money” by going with a lab-grown diamond for your engagement ring but that might also mean potentially overpaying for insurance in the event that you lose the diamond.

Takeaways

Changing trends in consumer tastes will continue to increase lab-grown sales and Signet Jewelers SIG 0.00%↑ is one of the few publicly traded companies for investors to take advantage of. However, the overall market is still dominated by traditional diamonds and that should not be ignored.

I think it will be very interesting to see how the split plays out between those that create a new level of “status” between a mined vs. lab-grown diamond.

Certifications can create a new class of authenticity over the next few decades.

Additionally, I recently launched a new weekly newsletter called

where I compile recent equity investment ideas, Twitter posts/threads, and general research all in one place.If you’re interested in getting new ideas once a week, hit the button below to sign up.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

HoldCo Twitter: @cedargrovech