Welcome to our Consumer and Retail recap where we share noteworthy headlines, updates, and insights. Never spam.

Table of Contents:

Company Announcements

Industry News

Corporate Shake-ups

Insider Buying/Selling

Regulatory Updates

Macro News

Company Announcements

Kohl’s KSS 0.00%↑ announced it’s introducing a new in-store and online experience that is designed to embrace inclusivity, bring discovery and inspiration to every store trip and online visit.

Why this matters? - Kohl’s has had a rough few years and most recently, a rejected takeover offer from FRG. The company seems to be losing sight of who its core customer used to be and are trying anything and everything to right the ship. This included being Amazon’s return center and having stores within a store concepts.

Walmart WMT 0.00%↑ to buy 4,500 electric vehicle fleet for last-mile deliveries from Canoo GOEV 0.00%↑. Financial terms of the deal aren't being disclosed, but a contract Canoo has with NASA to build two rugged, custom astronaut transports is valued at nearly $150,000.

Why this matters? - Using EVs for last-mile deliveries — from store to door — will help Walmart get closer to its goal of zero emissions by 2040. Additionally, Walmart will be able to provide customers and Walmart+ members with even more access to same-day deliveries while keeping costs low.

Peloton PTON 0.00%↑ announced it will completely out-source the production of its bikes and treadmills to Taiwanese manufacturer Rexon in an effort to reduce costs.

Why this matters? - Peloton is hemorrhaging money and the company is desperate to make any and all steps to stem its cash burn. Its most recent earnings showed losses of some $757 million.

Xponential Fitness XPOF 0.00%↑ Club Pilates has signed a Master Franchise Agreement in the United Kingdom, including England, Scotland, Wales and Northern Ireland The agreement gives the Master Franchisee the opportunity to license at least 50 Club Pilates studios over the next 10 yrs.

GameStop GME 0.00%↑ launches a non-custodial, Ethereum Layer 2-based NFT marketplace.

Take-Two's TTWO 0.00%↑ Rockstar Games shelves plan to release Red Dead Redemption 2 for PS5 and Xbox Series X/S.

Vista Outdoor VSTO 0.00%↑: Callaway Golf ELY 0.00%↑ initiates a long-term plan to integrate technology from Vista's Foresight Sports throughout its network of brands.

Starbucks SBUX 0.00%↑ said that it is closing 16 U.S. stores after workers reported incidents related to drug use and other disruptions in cafes.

Why this matters? - Starbucks has had a tough 2022 with unions forming in its stores, China lockdowns slowing sales, and the recent ousting of its CEO only to be replaced again (temporarily) by Howard Schultz. The last thing it needs is more stores closing due to crime and lack of order in surrounding areas.

Victoria's Secret VSCO 0.00%↑ announces new corporate leadership structure uniting its three lines of businesses as a single, collaborative organization resulting in an estimated $40 mln cost reduction in the run rate on an annualized basis starting in Q3.

Kroger KR 0.00%↑, America's largest grocery retailer, announced the national launch of Boost by Kroger, which represents the latest expansion of its industry-leading loyalty program.

Why this matters? - In a what seems a never-ending race to increase customer retention, Kroger is joining the fight against rivals like Amazon and Walmart. The annual membership provides customers unlimited free grocery delivery on orders of $35 or more, fuel discounts of up to $1 per gallon and additional savings on Our Brands products. Kroger estimates the membership can save customers more $1,000 per year on fuel and grocery delivery.

Nike NKE 0.00%↑ and Fanatics Inc. have signed a long-term deal to design and manufacture collegiate sports apparel, sharing the rights to serve a number of major universities.

Altria MO 0.00%↑ announced it will raise list prices on all cigarette brands by $1.50 per carton. The price increase is effective on shipments on or after July 17, 2022 (source: RBC).

Disney’s DIS 0.00%↑ ESPN will raise the price of its streaming service by 43% next month, betting that it can help cover the escalating cost of sports rights without losing subscribers who are grappling with soaring inflation.

RUMOR: Starbucks to reportedly sell Russian business to restauranteur Anton Pinskiy. Pinskiy is expected to be the co-owner of the Russian coffee shops along with rapper Timati and the Sindika holding company.

Juul seeks new financing to boost flexibility as it faces legal battles.

Why this matters? - Juul could lose its 30% market share in the US if the FDA’s ban is upheld and Altria owns an over 30% stake in the company.

Amazon’s AMZN 0.00%↑ drone delivery is coming to Texas - Amazon will be adding Texas A&M University’s home base of College Station to the list.

Amazon AMZN has started drastically reducing the number of items it sells under its own brands, and the company has discussed the possibility of exiting the private-label business entirely to alleviate regulatory pressure, according to people familiar with the matter.

Amazon reports Prime Day 2022 was the "biggest prime day event ever.’ Customers spent over $3 billion on more than 100 million small business items included in the Support Small Businesses to Win Big sweepstakes.

Industry News

Amazon — Bloomberg reported that the number of U.S. Prime customers stalled in the first half of the year, possibly in part because of the $20 membership price hike that took place in February. Amazon had 172 million members on June 30, level with six months prior, the report said, citing Consumer Intelligence Research Partners.

Why this matters? - The number of Prime members in the US stagnated in the first half of the year, suggesting a $20 annual price increase that took effect in February may be turning off potential customers struggling with high gas prices and inflation. If Prime members are stagnating, could this mean that Amazon marketplace might also be slowing down as well?

Lenovo: Worldwide shipments of traditional PCs declined 15.3% year over year to 71.3 million units in the second quarter of 2022, according to preliminary results from the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker.

Why this matters? - While rankings among the top 3 companies did not change, Apple AAPL 0.00%↑ did manage to slip into the fifth position, tying the company with ASUS, as production dipped during the quarter. As a result, Acer found itself in 4th place this cycle. Barring any further supply issues, IDC expects Apple to ramp up its production in the second half of the year.

Moviegoers are leaving their couches for theaters, bringing summer box office sales close to pre-pandemic levels.

Why this matters? - With new blockbusters driving more people to theaters, the summer, box office season in the U.S. and Canada is down just 12% compared with the summer before the pandemic, according to data from Comscore. Between May 1 and July 10, the box office raked in $2.27 billion from tickets. That’s compared with $2.58 billion during the same period in 2019. Companies like Comcast CMCSA 0.00%↑, Paramount PARA 0.00%↑, Warner Brothers WBD 0.00%↑, and Disney DIS 0.00%↑ stand to benefit.

June 2022 consumer spending across video game hardware ATVI 0.00%↑ , content and accessories fell 11% when compared to a year ago, to $4.3 billion. Growth in subscription spending could not offset declines in other areas of spending.

Video game hardware dollar sales fell by 8% when compared to a year ago, to $371 million. First half new console hardware spending fell 9%, to $2.1 billion.

June 2022 spending on video game accessories fell 15% when compared to a year ago, to $176 million. First half video game accessory spending declined 14% versus a year ago, to $1.1 billion.

Corporate Shakeups

Dollar General DG 0.00%↑ announced Todd Vasos's decision to retire from his position as CEO effective November 1, 2022.

Gap GPS 0.00%↑ replaced chief executive Sonia Syngal after a little more than two years on the job, making her the latest leader who has been unable to help the casual clothing company regain its status among American shoppers.

Dave & Buster's PLAY 0.00%↑ announced a series of executive appointments to form a new leadership team that will support Chief Executive Officer, Chris Morris.

Black Rifle Coffee Company BRCC 0.00%↑ appoints Roland Smith as executive chairman. Mr. Smith assumes the chairmanship from Founder Evan Hafer, who is continuing to serve as Chief Executive Officer and a Board member.

Red Robin Gourmet RRGB 0.00%↑ names G.J. Hart as its next CEO replacing Paul Murphy who is retiring.

Kohl's CTO steps down, names Siobhn Mc Feeney as CTO.

Regulatory Updates

Callaway Golf ELY 0.00%↑: Justice Dept. to investigate if PGA Tour engaged in anticompetitive behavior as it relates to LIV Golf circuit.

Crocs CROX 0.00%↑ secures long sought-after judgment of infringement against USA Dawgs and Double Diamond Distribution.

Amazon: EC seeks feedback on commitments offered by Amazon concerning marketplace seller data and access to Buy Box and Prime.

Why this matters? - The Commission preliminarily found that the rules and criteria for the Buy Box and Prime may harm other marketplace sellers, their independent carriers, other marketplaces, as well as consumers that may not get to view the best deals.

Insider Buying/Selling

Petco WOOF 0.00%↑ - Justin Tichy, Chief Pet Care Center Officer on July 7 sold 6,500 shares for $102,310. He owns 78,142 shares in total.

Stitch Fix SFIX 0.00%↑ – Benchmark Capital’s Bill Gurley bought one million shares at an average of $5.43 per share, according to an SEC filing. Gurley, who serves on the Stitch Fix board, already owned 1.22 million shares prior to the latest purchase.

RH RH 0.00%↑ President, Chief Creative and Merchandising Officer and Director sold 10,000 shares at $257.25 - $264.54 worth ~$2.6 mln.

Macro News

The gambling enclave of Macau begins a one-week shutdown to try to contain the spread of Covid-19. Companies like Wynn Resorts WYNN 0.00%↑, and Las Vegas Sands LVS 0.00%↑ have exposure in the area and will likely see a stumble in earnings.

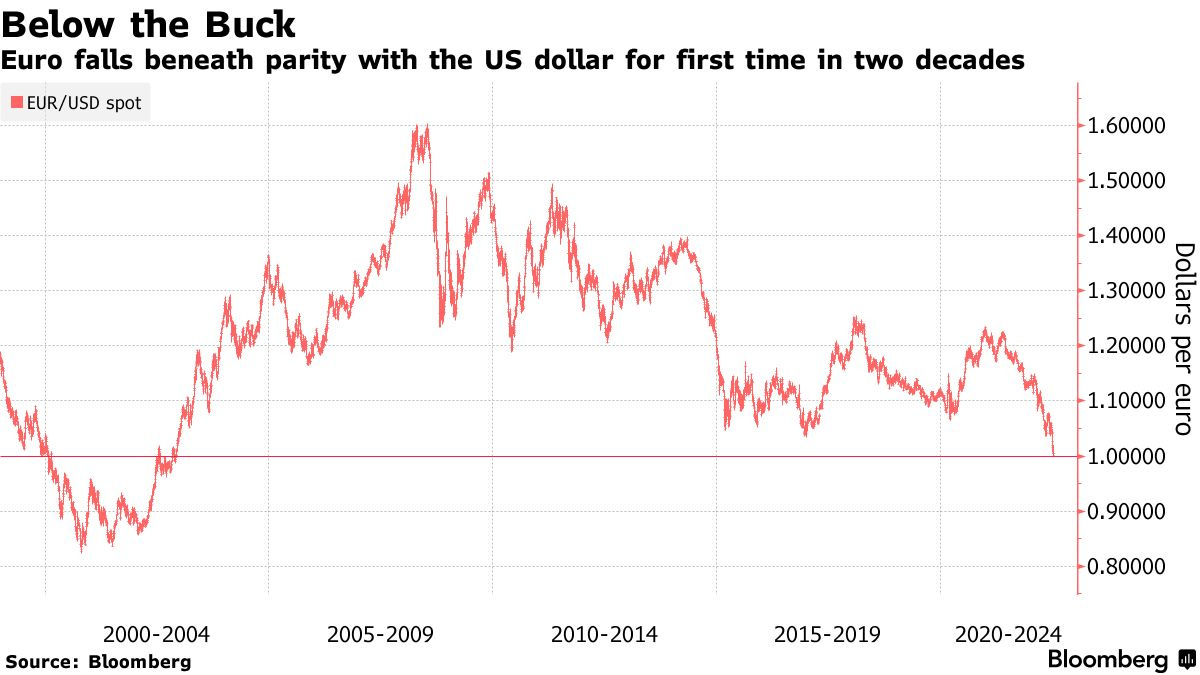

Euro drops to dollar parity for first time in two decades.

Why this matters? - For American tourists to the EU, it’s great. Your money goes a lot further and you can buy more goods than you could have otherwise just a few short years ago. For multinational companies, this sucks. Incurring unfavorable FX rates when recognizing revenue hurts multinational companies when it comes to reporting time. Money made overseas is now worth less. For the ECB, a weaker currency poses an extra headache because it will add to the region’s inflationary pressures by increasing the cost of imports.

Don’t Want A Weekly Recap?

As an avid reader and subscriber of other research myself, the last thing I want is to be bombarded with emails that I don’t actually want, i.e. spam. I never want this for you with any of the content that I make.

If you would like to continue getting all my other research (ex, equity research, charts, trade ideas, etc) but not the Weekly Recap, please follow the three-step instructions below.

Click “unsubscribe” at the bottom of this email

Then it will open your email settings and ask which section you’d like to “turn off emails” for

Select “turn off emails” for Weekly Recap - BOOM you’re done

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm

Paul - great content, I enjoy reading your work. I spent the last 15+ years running consumer focused portfolios for Citadel and Millennium so I connect to your consumer focused research. Would love to connect sometime (message me).