Coinbase (COIN), Leading the Way in the Crypto Market

Why Coinbase is poised to become more than just your average crypto exchange

Summary

Massive top-line growth and margin expansion will continue to pump out large amounts of cash to drive further customer acquisition and product innovation.

The growth of crypto adoption globally, both on the retail level and institutional level will continue to fuel its member base within its digital ecosystem.

New revenue-generating products in the near term and long-term will position Coinbase to become one of the biggest crypto financial services companies in the world.

Interested investors will have to stomach the ebbs and flows of the crypto market as it slowly establishes its footing given the company’s direct exposure to the market.

Business Overview

Coinbase Global, Inc. COIN 0.00%↑ provides financial infrastructure and technology for the crypto economy. The company provides a primary financial account for the crypto economy, a platform to invest, store, spend, earn, and use crypto assets. For many crypto enthusiasts, Coinbase operates as a straightforward online exchange, allowing retail buyers and sellers to meet in the middle and find a price. For more experienced users, Coinbase offers a robust trading platform—called Coinbase Pro—with a full set of features and charts to help you plumb into the depths of the crypto market. It also offers a free wallet service that allows users to safely store their cryptocurrencies.

How Coinbase Makes Money

Coinbase doesn’t charge you to store your cryptocurrency in its popular wallet service. Instead, it earns fees and commissions when you actually buy and sell cryptocurrency, like Bitcoin and Ethereum. These include:

Margin fee. Also known as the spread, Coinbase charges about 0.50% for crypto purchases and sales, although this rate varies depending on market conditions. The margin fee you end up paying depends on the change in price between when you get a price quote and when the order is actually completed.

Coinbase Fee. This is a commission on all crypto transactions, charged in addition to the spread. How much you actually pay depends on your location and the total amount of your transaction.

Coinbase has several other lines of business in addition to its exchange services.

Coinbase Commerce. This service provides online retailers with software that lets them accept cryptocurrency payments. Think of PayPal, but for crypto—Coinbase’s plugins are used on a variety of e-commerce platforms.

Coinbase Card. Coinbase is in the early stages of giving its users a physical Visa debit card and an accompanying app to spend cryptocurrencies in the physical world by converting crypto to U.S. dollars when used.

USD Coin (USDC). Coinbase offers its very own cryptocurrency, USD Coin (USDC), which is built on the Ethereum platform. Its value is tied to the U.S. dollar, so 1 USDC is always worth $1.00. This is also known as a stablecoin.

Recent Stock Performance

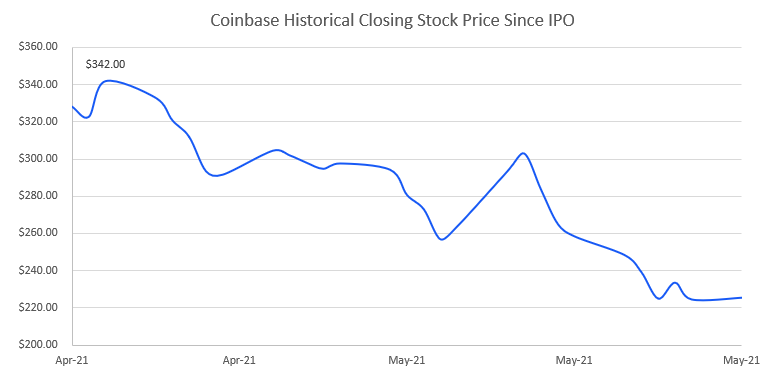

Coinbase became public through a direct listing rather than the traditional ‘hire an investment bank’ to go public way. They had a reference price of $250 a share and opened for trading at $381 a share and quickly climbed to $429.54 before trending downwards, valuing the company at over $100B at its peak.

Shares have been trending downwards ever since then from a combination of a market selloff starting a few weeks back to the ever-increasing volatility of Bitcoin and the cryptocurrency market.

Why It’s A Buy

Just to be clear, this article is in no way shape, or form a primer on cryptocurrency, Bitcoin, or any other altcoin out there (shoutout to worthless Doge). This article is specifically geared towards why I think Coinbase will be able to capture huge market share and set the stage for how investors involve themselves in crypto going forward.

The Good

Despite the pullback in its overall value, fundamentally, the company is growing rapidly, the second biggest crypto exchange as far as trading volume, and is even printing cash, i.e. profitable.

Topline growth and margins to the moon!

Yes, that section title was a joke, don’t take it seriously (cue Joker, “Why so serious?”).

Anyways, the company posted record sales of $1.12bn in its Q1’21 earnings release. This is compared to all of its 2020 sales of $1.27bn. Granted, Bitcoin started getting much traction at the end of 2020 and as I’m sure we all know, the beginning of this year as well. On top of record sales, the company’s margins have dramatically improved as well posting adj. EBITDA margin expansion of ~3,300 bps.

Like I mentioned previously, the company is highly profitable, and for now, is generating a high bottom-line margin for an exchange, 42.8% to be exact or in absolute terms, $771M. Generating cash flow is not currently an issue for Coinbase which is great considering that most tech companies when they go public are hemorrhaging money. Shoutout to Uber!

The number of users and assets continue to grow

As part of their growth story, they need people to sign up and actually use their service. As of the most recent quarter, they had over 56M verified users, an increase from 43M in Q4’20.

Monthly transacting users (MTUs) are users that have made either an active or passive transaction at least once in the prior rolling 28-day period, which has grown to over 6M. The company has stated however that the increase in MTUs is a strong correlation with volatility in crypto assets. I.e., the more cryptocurrencies move up and down, that’s when more buyers and sellers start transacting, in theory.

The dollar value of crypto assets on the platform has also increased significantly, which is defined as the total U.S. dollar equivalent value of both fiat currency and crypto assets held or managed in digital wallets on their platform.

With the introduction of more coins on the platform and Elon Musk continuing to tweet about whether or not Doge is “the coin of the people” (will touch upon this later), more transacting volume should occur as time goes on thus driving overall fee generation.

New growth channels

Being a solely transactional fee-based exchange is not going to cut it. It’s highly replicable, not very defensible and with commissions eventually going to zero, these crypto exchanges need to diversify. So that’s what Coinbase has done and is continuing to do.

Since 2012, Coinbase has been expanding the ways it generates revenue through the different business segments (mentioned previously), slowly becoming the more one-stop-shop place for all your crypto needs. This is critical if they are to divert to other revenue streams aside from fees based on transactions which currently make up over 85% of their total revenue.

They also recently announced that they would be creating a media arm in an effort to gather more customers via top of funnel, write their own narratives, and generate ad revenue in the meantime.

I believe that they’ve checked off many of the basic boxes needed for retail investors to want to stay on the platform other than just coming to trade but what I think will be the cherry on top is what they eventually go into next. More on this later.

Continued momentum in crypto adoption

Rewind 4 years ago and many people had no idea what Bitcoin was or what a block of chains could really solve (that was a joke). Fast forward to 2021 and things have changed. A May 2021 survey by Mastercard and The Harris Poll reveals 40% of people around the world plan to use crypto assets in the next year, with 67% of millennials reporting interest in the technology.

This can be further supported in the company’s recent earnings report where they estimate that they would end 2021 with 7M MTUs.

High: Average 2021 MTUs of 9.0 million. This scenario assumes an increase in crypto market capitalization and moderate-to-high crypto-asset price volatility. In this scenario, we expect that MTUs continue to grow for the remainder of 2021 relative to Q1 2021.

Mid: Average 2021 MTUs of 7.0 million. This scenario assumes flat crypto market capitalization and low-to-moderate crypto-asset price volatility. This scenario assumes modest growth in MTUs for the remainder of 2021 relative to Q1 2021.

Low: Average 2021 MTUs of 5.5 million. This scenario assumes a significant decrease in crypto market capitalization from current levels, similar to the decrease observed in 2018, and low levels of crypto-asset price volatility thereafter. In this scenario, we assume MTUs will decrease in a corresponding manner and end 2021 at similar levels to Q4 2020.

What’s also important, and driving the price of crypto higher, is the adoption and usage of crypto in the real world when it comes to merchants and institutions. Besides the over 56M verified users on the platform, Coinbase has over 8,000 institutions and over 134,000 ecosystem partners on their platform. This is up from 7,000 institutions and 115,000 ecosystem partners as of December 2020.

More adoption = more users = more trading/services being used = more $$.

You have to give it to them, they’re putting in sweat equity to make sure that their platform is trusted more within the business community aside from just retail investors.

The Bad

Bitcoin correlation

Traditionally, exchanges and brokerages who make money based on fees tend to not move in sync with the underlying security they’re allowing to trade, aka, just because Apple surges 5% in a day does not mean that so will Charles Schwab. However, this is not the case with Coinbase and Bitcoin since it seems to be almost directly correlated with one another.

If we look at the closing prices of COIN and BTC since the company went public, you can see that though the changes might not be 1:1, they still move directionally together. Odd that this happens since the company makes money on how many transactions are made but since Coinbase has direct exposure to BTC, and crypto in general, investors might get spooked or enticed as crypto changes, thus all crypto exposed companies prosper or suffer.

Elon Musk

With the above being said around the correlation of COIN stock to crypto price swings, I need to address the other elephant in the room. My inspiration, my muse….Elon Musk. Let’s be honest, this guy is wicked smart but also does not have a filter, which has gotten him in trouble with the SEC in the past (#420).

What’s unique with Elon though and crypto is that retail investors hang on to every word the man says via his tweets.

This is a big problem given how much power he has with his tweets, which in turn affects Coinbase’s stock price. Though it’s not an inherent risk to their fundamental business model, it’s a big risk that everyone needs to be fully aware of since it will drive future volatility.

Willy Wonka’s Golden Ticket

As previously stated, the company is quickly moving into areas that not only generate revenue but also keep its users within its own ecosystem.

Here’s where things get interesting and what inevitably made me realize the potential of Coinbase. It was the news that they might acquire an asset manager called Osprey Funds. Now at face value, I don’t care much if they acquire Osprey Funds, since I know little about it or any other asset manager. What I care about is the why. Coinbase has much bigger plans than where they currently are in their life cycle, which is great because that shows that Brian Armstrong and his team are consistently thinking about the future. If they are looking about acquiring an asset manager in order to fulfill this goal, then they are thinking right.

This puts Coinbase into a new category. It’s not just a high-growth tech startup now, nor just a regular exchange that collects revenue on fees. They are looking to fully become the one-stop-shop for investors looking to gain access to a wide variety of crypto-related products (spending, savings, trading, investing, possibly retirement planning, etc.).

With the overall market and adoption growing, this is like betting on the next Charles Schwab/Nasdaq/BlackRock in the making, but for crypto. Coinbase would be used in handling a large number of assets for various reasons that modern financial services currently operate in with fiat currency (dollar bills).

With that being said, this now leads me into how I believe we should value Coinbase.

Valuation Support

Because Coinbase should be treated as both a high-growth technology company and also a financial services company, this changes the way investors should value the company.

I decided to focus on FWD P/E since Coinbase does spit out a large amount of cash, and pick names in the tech and financial services space. Because of my emphasis on pricing the company’s value on earnings, that rules out a lot of high growth tech companies that could be compared to Coinbase since most don’t currently make money.

Next, I wanted a wide variety of financial services that Coinbase either currently operates in or where I believe they will in the near future.

Paypal for digital wallets, payments their ecosystem of digital banking products.

ICE and Nasdaq as exchanges.

Charles Schwab, Blackrock, Intuit, and Paychex for the asset management services or general financial services for retail investors and businesses.

With earnings estimates, on a per-share basis, for Coinbase for fiscal year 2021 at $8.16, and applying a median multiple of 47.7x, you arrive at a price of $389.34. Should you apply the mean multiple of 41.7x to the same per-share earnings estimate, you arrive at a price of $340.64.

Upside since last closing price based on above multiples and per-share data:

Mean: +51.2%

Median: +72.8%

Conclusion

Coinbase is a company in a brand new category to ever hit the public markets. The dawn of what I believe will be a new wave of crypto-related companies taking advantage of the crypto market in its infancy.

With management’s head on straight to identify long-term growth prospects, a great platform with a large number of active users, growing adoption rate of crypto in general, and with the significant pullback the company has had so far since going public, I believe that Coinbase is a great company to hold for the longterm.

*The current stock price at the time of this article: $229.