Black Friday: Fools Gold Indicator

Why you need to be cautious of preliminary headlines from consumer spending this holiday

If you like today’s post, please be sure to hit the heart button, comment with any feedback, and share it with friends if you find it useful.

For those of you who have recently started following me, I published my opinion article about how the consumer was not okay on September 6th.

In this article, I explained that this recent retracement to the upside was short-lived and how there were underlying signs in the economy that signaled to me that the consumer was actually worse off than many believed they were.

This prompted me to liquidate our long positions and wait until I believed this run-up was losing steam. However, the narrative of inflation has really been driving the markets rather than how the consumer is doing. Fortunately, many believe that inflation has peaked and the FED will slow down its hikes which led to the market puttering out a few more positive gains before flatlining at the time of writing this.

While this might be true, this temporary thinking is masking the bigger problem. The consumer is running out of steam and some areas of the market are finally representing that.

I’ve been very vocal how the investor’s perception that the light at the end of the tunnel isn’t the FED stopping rate hikes but rather another oncoming train of the consumer finally starting to hunker down and slow spending dramatically.

This is why I’ve said that this holiday season (Thanksgiving + Christmas) will be the last hurrah for the consumer and that there will be excellent deals in the market post-Q4 earnings when shit hits the fan.

So why am I writing this piece? It’s because over the weekend I saw many people sharing headlines from Shopify and other publications about how sales this Black Friday season are up Y/Y. But while this might be true at first glance, there’s more under the hood that you need to be aware of before you think the worst is over.

Retail Sales Context

To understand the background of retail sales, I’ve pulled recent commentary from one of my favorite macro writers, Charlie Bilello.

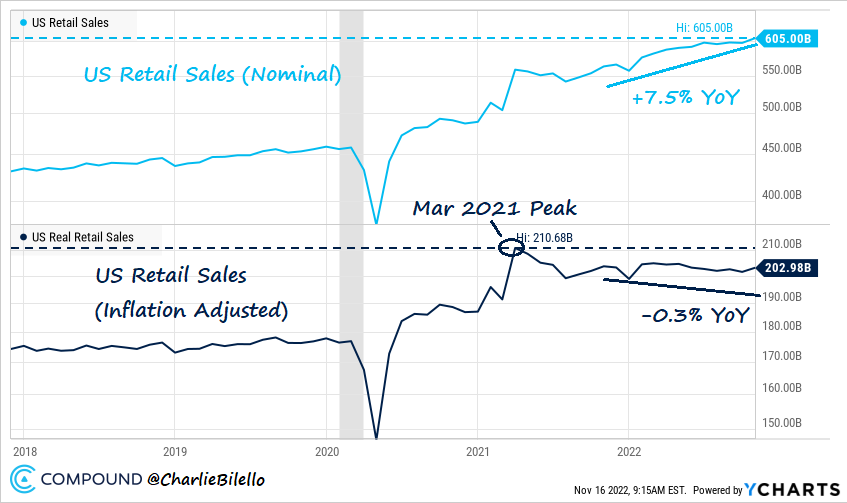

Despite negative consumer sentiment, US Retail Sales still appear to be booming, rising 7.5% over the last year and hitting a new high in October. But after adjusting for inflation, the story changes. Real Retail Sales peaked in March 2021 and are down 0.3% over the last year.

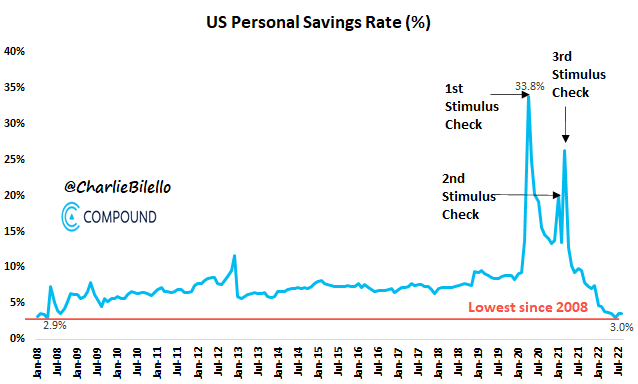

Given the wide gap between inflation and wages, how has the US consumer been able to maintain their spending? They’re borrowing more and saving less.

Credit Card balances in the US increased 15% over the last year, the biggest jump since the 2001 recession.

Savings rates are down to 3%, their lowest level since the 2008-09 recession.

The takeaways from this are

Nominal retail sales are up

Real retail sales are down

Credit card balances rising almost as fast as ‘00

Savings rate at the lowest level since 2008

If you think any of this spells out that the consumer is in good shape, that’s your opinion but let’s look specifically now at why this holiday’s headlines are not a saving grace.

Inventory Problem

If you also might recall, I shared a chart on August 29th about how you need to put things into perspective when it comes to analyzing companies’ growth with inventory levels.

The chart (above) showed how sales growth was not exceeding inventory growth over the same time period. Now, this isn’t new news, in fact, we really first heard about this through Walmart and Target back in May.

This sent the stock market cratering until it hit its June lows. Inventory is slow to move because retailers spent so much money trying to front-run COVID supply chain issues and once the economy re-opened, consumers already had much of their hard goods and moved over to services and experiential transactions (ex, traveling and restaurants).

This issue is causing warehouse demand to explode to store all the unsold goods.

“We’ve also seen a 20% year-over-year rate increase for warehouse space, so we are seeing significant inflation there. We are also reporting seven consecutive quarters of positive net absorption. Warehouse capacity for imports remains to be an issue across the U.S.”

- Ben Hagedorn, CEO of Warehouse Quote

The influx of unsold goods creates a problem that needs to be solved quickly but without heavy discounts. Heavy discounts can create brand erosion by giving the consumer the idea that perhaps whatever they’re buying isn’t actually worth the full price they were traditionally used to paying.

BUT, this is a double-edged sword that people need to be aware of, just because you can move inventory — i.e. sell goods through — that means you will suffer a hit to margins.

All of this is nothing that I haven’t shared opinions on prior to Thanksgiving via Twitter.

One of the best quotes from Ben I’ve also included below which should help you paint a better picture of the mentality of CEOs.

Broader trends his firm is seeing inside the warehouse are a transition from the “just in time” to the “just in case” mentality among companies, and inventory-to-sales ratios “continuing to go up across industries.”

Dick’s CEO Lauren Hobart described 40%+ inventory in late May as “healthy.” In hindsight, it’s almost like we deserved this.

But here are the takeaways

COVID supply chains made companies play catch up with the demand

Reopening switched spending from not just goods but rather more experiences and services

Inventory build-up is hurting retailers’ ability to generate sustained earnings growth

Retailers need to get rid of their inventory which will directly lead to margin compression

It’s rather simple, retailers discount their goods (lower margin) to move them. At face value, they’ve “sold” a lot but the cost of doing so means they’ve made less on each good they’ve needed to discount.

🙌🏼 Earnings compression 🙌🏼.

What’s good for the consumer ends up being bad for the retailer.

Headlines

Black Friday 2022 e-commerce reaches record $9.12B, Thanksgiving $5.3B; BNPL and mobile are big hits

The Good (allegedly)

Black Friday broke $9 billion in sales for the first time on Friday, with online sales of $9.12 billion, according to figures from Adobe Analytics. This is a record figure for the day, and up 2.3% on sales figures a year ago, and slightly higher than Adobe had estimated leading up to the day.

Salesforce publishes its own figures based on 1.5 billion shoppers, and it noted that online sales reached $8 billion in the U.S. and $40 billion globally at 5 pm ET on Black Friday with the most discounted items in the U.S. appearing in home appliances, apparel, health and beauty, and… luxury handbags.

The day before, Thanksgiving, also had stronger than expected numbers: shoppers spent $5.29 billion online on Thursday. That is up 2.9% from a year ago, and ahead of the $5.1 billion Adobe initially said it was expecting for the day. Salesforce noted that online sales grew 1% on Thanksgiving day to $31 billion, while in the U.S. specifically, they were up 9% to $7.5 billion. Salesforce also said that 78% of sales traffic came from mobile devices. Average order values, it said, were $105 globally and $120 for U.S. sales.

For the weekend, Adobe predicts online holiday spending of $4.52 billion on Saturday and $4.99 billion on Sunday.

There are obviously conflicting numbers here between Salesforce and Adobe but we won’t know fully which is more right until we understand how they’re cutting the data exactly.

Until then, what many have been sharing around are Shopify’s numbers.

Shopify announced a record-setting Black Friday with sales of $3.36 billion from the start of Black Friday in New Zealand through the end of Black Friday in California. This marks a 17% increase in sales over Black Friday in 2021 (19% on a constant currency basis).

At its peak, merchants on Shopify saw sales of $3.5 million per minute at 12:01 PM EST on Black Friday, collectively.

It all sounds great, right? Wrong.

The Bad

While in-store shopping was more in focus this year due to loosening COVID-19 restrictions, that doesn’t mean there was a return to the old chaos of Black Friday shopping. Several analysts noted that traffic was brisk and certainly apparent at a variety of stores, but didn’t have the long wait lines the holiday used to be infamous for.

“People have been shopping today. We’d expected brisk traffic and big sales numbers. We got the brisk traffic, and we’ll soon know if that translated into positive numbers for the retailers,”

This is a very similar observation where you see a ton of people “out shopping” but not many of them have shopping bags. They’re present, but that doesn’t mean they bought a lot, or much at all.

I saw plenty of this by myself this past week. Also, given how some parts of the country had poor weather conditions (snow/rain), many consumers could have easily just forgone buying in person and opted in for online shopping.

There’s a problem with this though, online retail sales create earnings issues for retailers.

Online stores cost retailers way more than if they lured in consumers to the stores. This is why historically places like Best Buy, Walmart, and Target would have “doorbusters.” These great deals would only be available for those that took the time to go to the store, wait in line, and buy in person.

This helps retailers by not taking a margin hit from shipping and why many have opted in for BOPIS services (buy online and pickup in-store).

So if retail e-commerce sales are up, that means that retailers would be spending more on shipping with already compressed margins from discounting, and then they also run the risk of having to deal with returns that account for 21% of order value.

Get the picture yet? Let me bring you to my next bad data point. BNPL.

Many consumers embraced flexible payment plans on Black Friday as they continued to grapple with high prices and inflation. Buy Now Pay Later payments increased by 78% compared with the past week, beginning Nov. 19, and Buy Now Pay Later revenue is up 81% for the same period.

Once more, if you follow me on Twitter, you will know that I absolutely hate BNPL. It’s such a scam and is just another way the consumer overextends themselves without having full repercussions like using a credit card.

This BNPL behavior is such a short-term fix for a long-term problem. You can’t afford something now so you punt it out a few extra cadences in order to afford it.

Reading between the lines, people can’t afford things on traditional credit so they’re pivoting to a new form of credit in order to do so. For those of you that don’t know too, BNPL charges the merchant so that means less profit going to the retailer to offer said service for each product. 🚩 #487.

Takeaways

Despite the record online spending this Black Friday, consumers' concerns about the economy are at the highest level since the Great Recession in 2008-2009. More than 60% of Americans said the state of the economy was impacting their holiday spending plans, according to the NRF.

No bueno, but here’s what I think will happen before anyone comes at me.

Consumers will spend what little they have left to spare this season to take advantage of discounts and then pull back

Retail sales will be good nominally, but not in real terms because of inflation

The need to clear inventory will ding margins (aka earnings)

Retailers will report good(ish) holiday sales but warn on guidance for calendar ‘23

The stock market ≠ the economy so for those that say the stock market is forward-looking, while true, does not mean that it’s accounting for what is coming.

Time will tell but all data looks to be pointing towards at least another leg lower.

Until next time,

Paul Cerro | Cedar Grove Capital

Personal Twitter: @paulcerro

Fund Twitter: @cedargrovecm