BARK: The New Dog Co. on the Block

Why BARK, the parent to BarkBox, is the up and coming dog DTC company subscription company with stellar unit economics

Summary

The company’s continued expansion into other pet industry subscription products will allow it to further cross-sell, boost overall revenue at a much lower CAC, and improve LTV per customer

Bark boasts a higher gross margin business relative to its peers, granting it significant operating leverage as it moves toward achieving profitability

Favorable unit economics such as increased AOV and monthly retention allows for quicker payback periods and longer lifetime per customer

Push from being a digitally native brand to a more omnichannel one will provide Bark with access to further market penetration and brand awareness within the pet industry

Large cash balance post-merger will allow it to further push itself into various growth opportunities

Business Overview

Bark BARK 0.00%↑, the parent company to BarkBox, announced it would go public via merging with blank check company called Northern Star Acquisition Corp. in December for $1.6B. Though I was hesitant after the SPAC mania and eventual pop earlier this year, Bark is in an interesting company that seems to be one of the better ones to go public that doesn’t have a sky-high valuation expectation.

Founded in 2012, the company sells personalized dog care packages through its DTC subscription channel. Bark started with its first subscription box called BarkBox, where it delivered monthly themed plush toys and treats. Since then, the company has expanded into different areas of the pet industry with the same premise of a subscription box model.

The company also has over 1.1M active subscriptions, 6.5M BARK customers, 11M total contacts, and over 8.5M social media followers, as per their management presentation.

Investment Thesis

Being a thematic investor and a dog owner/lover, I believe the pet industry is a place for massive upside. I have written two previous articles pitching Petco (WOOF) as one to hold for the long-term and Chewy (CHWY) as one to short.

As mentioned above, I was at first skeptical recommending Bark because it had gone through the route of a SPAC to go public, but after reading their management presentations, I believe taking a starting position in Bark with its growth expectations could represent a 2-3x return in the next 3-4 years.

Let’s dive into the why shall we?

Growth! Growth! Growth!

Industry tailwinds to support further revenue growth

When first heard of Barkbox, I thought, “just a box full of treats and toys? How is that going to scale past a certain point?”. Sure enough, I was wrong.

Bark’s fiscal year ends in March so whenever you see it reference years, think about that timeline and what happened during it. If you need a refresher, their fiscal 2021 started right when we all went into lockdown, puppies were being adopted left and right into families, and more or less ended when many were getting the vaccine and things were opening up again. Perfect timing for a fiscal year if you ask me.

Revenue grew +68.9% from fiscal 2020 and management is predicting revenue to increase to $516M and $706M in the next two years, or a growth rate of +36.1% and +36.8% respectively.

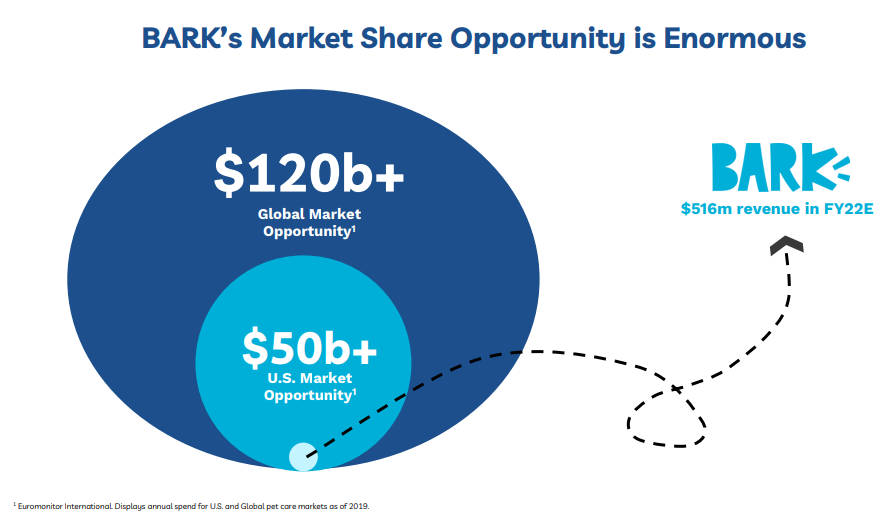

They’ve been another pet company to take advantage of supporting industry tailwinds in the pet industry and management doesn’t see this slowing down anytime soon. Right now, of the $50b+ U.S. pet market, Bark is just a small fish in a large pond ready to swallow up market share via its various product offerings.

The real question is, how do they set themselves up for future success beyond just toys and treats?

You get a box! You get a box! Everyone gets a box!

Yes, that’s an Oprah reference. Hopefully, you got that.

Bark realized that growing a business on one type of subscription box would not yield them the growth that a DTC startup would need to be ultra-successful, especially when there are other pet companies out there that have either their own subscription services (basically everyone) or have their own pet subscription boxes (Petco - Pupbox, Chewy - Goody Box).

To expand their TAM, they opted to keep the same core business strategy (subscription boxes) and replicate it for other areas within the pet industry. This led them to create other Bark “boxes” that have different touchpoints.

Now with a total of five different subscription boxes, pet owners can now get their supplies ranging from basic toys, dental care, home goods to portion-controlled dog food. Basically, a variety of different care packages to fit your pup’s needs.

As a reference point:

Bark Home is currently available via Amazon marketplaces and Barkshop.com with additional product offerings coming in FY 2022

Bark Bright is currently available via subscription, CVS, Petco, and Petsmart with additional product offerings in FY 2022

Bark Eats is currently ready to ship to ~20 markets and plans to ship nationwide by the end of the calendar year 2021

With all of these boxes specializing in various parts of a dog’s everyday life, Bark has had the ability to increase revenue with its “add-to-box” option so customers can benefit from various combinations of supplies through cross-selling.

The box I’m most excited about is Bark Eats. As a dog owner myself, I am very conscious of what I feed Pepper (that’s her name and she’s beautiful) to the point where I decided to give The Farmer’s Dog a try which specializes in real, human-grade food but is expensive as hell (mine is $300 a month).

With personalized, portion-controlled, dry dog food, Bark has entered into the over $25b market for pet food. With 74% of dog parents giving dry food to their pets, and 57% of dog parents using some type of specialty formulated dog food to address specific needs (age, coat, weight), this particular subscription box should push their ability to grow top-line revenue well into the future with limited churn.

Vertical integration leads to better….everything

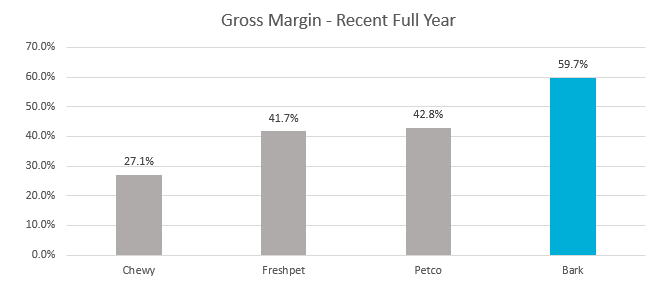

The company is already a vertically integrated company meaning that all of its products are designed, developed, and branded by Bark. This leaves them to drive higher gross margin, which sits at 59.7% as of fiscal year-end 2021, well above their respective peers.

The good thing about their gross margins is that they’re relatively stable. The input costs involved in creating these products do not vary widely so when we look to how they achieve profitability, starting off with a higher GM will allow Bark more room to spend on growth via advertising and marketing.

Though their margins are impressive, this isn’t the sole reason why I bring this up. Creating and building a successful DTC company is no easy feat and metrics matter. Some of these metrics include customer acquisition cost (CAC), average order value (AOV), order retention, and lifetime value (LTV).

CAC - how much in marketing dollars it takes to acquire one customer.

AOV - the average “basket” size per customer, aka, how much they spend in one sitting.

Retention - the rate at which the company keeps their customers on a subscription plan, calculated as 1 - the churn rate.

LTV - The dollar value per customer over their lifetime with the company.

Given that Bark is merging with a SPAC, there wasn’t consistent information where I could make visuals for you all. For example, they were able to release CAC and LTV but not overtime. One that I was able to get was their AOV.

Spoiler alert, they’ve been increasing their AOV steadily since Q1’20 and ended fiscal 2021 with $28.74 in AOV. This is good because that means that on average, people are adding more things to their cart as time goes on. More items added = more money and less needed in marketing for the same level of goods.

Another few points to make are that its monthly retention is 94.1% as of FYE 2021, which is freaking phenomenal. Having a higher retention rate means people are staying on the platform and it’s much easier to make back the money that you spent on marketing and improve how much your customer spends via the duration of them being on the platform (example of this below).

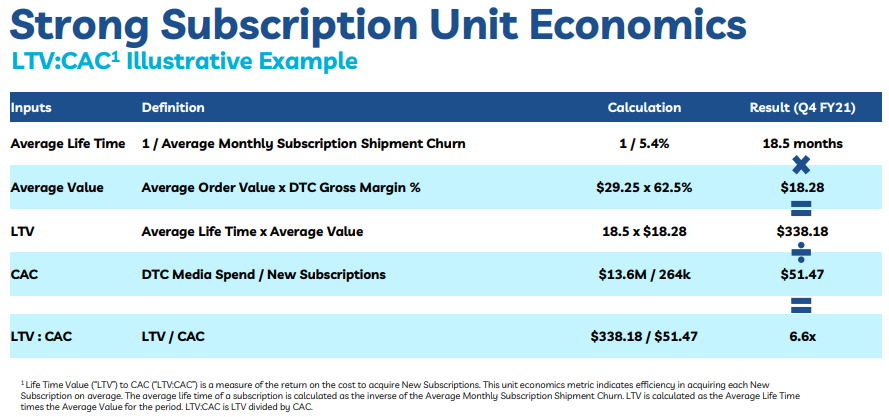

CAC ended FY 2021 at $47.55 and LTV was around ~$300. An example that the company gave in their recent management presentation breaks down exactly how this is calculated.

Based on the information above, the company has a payback of 4.5 months (how long it takes to pay yourself back on a gross margin basis based on your CAC) and has a 6.6x LTV:CAC ratio (the return on the cost to acquire a new customer).

This is all great news and should CAC come down over time with the ability to cross-sell, LTV will benefit overall and this should directly impact the bottom line in a positive way.

Digitally native meets retail distribution

Like many digitally native companies (started online), eventually, they all realize that retail isn’t such a bad thing. This same revelation happened to Warby Parker, AWAY, All Birds, etc. Bark has noticed this as well and has already begun to be a more omnichannel company. They’ve already had retail exposure with companies such as Urban Outfitters, Target, Subaru, Bluestone Lane, Glossier and are looking to expand this reach into more brick and mortar stores like Costco, Walmart, Petco, Petsmart, T-J Maxx, etc.

Their retail and marketplace sales already make up over 13% of total revenue during FY 2021.

One part of this push is Bark increasing their brand awareness on Amazon. Bark has stated in their December 2020 management presentation that their Amazon sales growth YoY grew by 2.5x and it’s estimated that the Amazon marketplace spend on dogs is to be roughly $4.3B. Even on their Amazon store page, they have plenty of ratings of 4-stars or higher.

Continued reach into various retail and marketplace platforms will help Bark drive further brand awareness, product discovery, and sales channel diversification.

Data-centric model fueling product innovation

One thing I like is a company’s defensible moat. Though there isn’t anything revolutionary about a dog subscription box, the data that comes from it is very critical.

With the company able to better understand the dog and owner better via the gathered data from the above image, they are able to curate custom boxes every month to keep your pup engaged and enjoying all their new stuff. From curating boxes that are for big breeds or small breeds to dogs that have allergies or prefer certain types of toys over others, making the boxes personalized and not generic keeps the pup and owner happy every month.

My company actually gifted all employees with dogs a 3-month subscription to BarkBox and it was definitely a nice surprise getting it in the mail every month. Pepper went crazy every time she smelled the box in the lobby.

What was cool was the themes that they were able to conjure up and the various toys and treats they provided. I remember one month I had a Peanuts-themed box with Snoopy being one of the toys and getting training treats since they knew she was a growing puppy.

Having insights like this helps contribute to the high retention they currently report and can always give your pup exactly what they need given their breed/age/diet restrictions.

I think given how long the company has been around, it would be difficult for a legacy pet company to replicate this, thus giving Bark a headstart. This is why I also believe that the company could be acquired, not only for the business itself and all the members that it currently has on its platform but because of millions of data points that it acquired over the years.

Valuation Support

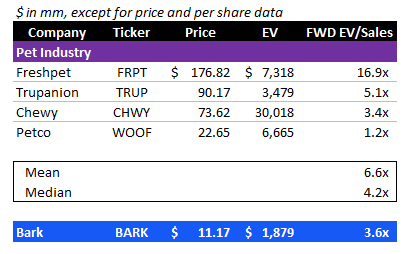

Sticking with the theme of being in the pet industry and also two of these players having their own dog subscription boxes (Petco and Chewy), I wanted to only show pet companies for the public comps. I had thought of other subscription-related companies like Stitch Fix, Blue Apron, and ThredUp but could not come to the conclusion that they would be the best to show for comps given their size and what industry they were in.

What is interesting is that even after Petco went public, Bark did not update their comps analysis to include them in the May 2021 presentation which skews things a little more in their favor. Tisk tisk, guys. I, however, included them in the table below.

Based on the mean and median multiples of 6.6x and 4.2x from the comps table above, the implied stock price ranges from $12.71 to $18.84. A +13.8% or +68.7% from its last closing price, respectively. I’m keen on learning closer to the mean multiple because though Petco operates in the pet industry, the market hasn’t given it a high growth multiple to trade off of so it brings down the overall peer multiple set.

Conclusion

Bark is a small fish in a pond full of other, much bigger fish. However, their unit economics cannot be ignored and they’ve successfully, for now, identified areas of opportunity for growth in a very meaningful way to boost the overall LTV of each customer and keep them on the platform for longer.

I believe that management will continue to innovate new ways to increase their AOV and cross-selling capabilities and with $490M in the bank after the transaction, they have the firepower to do so.

*The current stock price at the time of this article: $10.68 under the ticker STIC and will begin trading under BARK on June 2nd.