Are VCs And Bankers Helping Short Sellers?

In a hot private capital market, it seems like valuations have become really disconnected

Having a L/S portfolio, I can say with some satisfaction that I have a 100% hit rate on my short calls, while like many of us, longs have yet to be fully realized.

If you’re interested in reviewing my individual research, you can check it out via the button below.

But this begs to ask the question, did I take advantage of a mispriced market, or was it just a factor of macro conditions that allowed me to capitalize on short-term catalysts?

I argue it’s the former, but why do I state that VCs and Investment Bankers are helping me out? First, let’s chat about each’s roles in the context of a company strictly on its path to IPO.

The Role of VCs

I always thought being a VC was interesting because as a former investment banker from a past life, we had to be exact with our numbers while it seems VCs is more of a guessing game (somewhat). Everything had to have a reliable source that we could reference at a later date should anyone ask (client) or if legal needed to defend us if we got sued for whatever reason.

Depending on what stage of VC you are (pre-seed, seed, series A, late-stage, etc.), their role is to invest and back the company based on some variables.

A disruptor or clear differentiator?

How big the TAM is/could be?

Is management capable of achieving success?

Do financials and growth strategies support potential long-term success?

These are only a few of the many variables that VCs can look at so for any VC reading this, don’t @ me.

The Role of Investment Bankers

While investment bankers have many roles when advising clients, one of the biggest is their expertise when taking a company public. Taking a company public is one of the most gratifying events in a company’s life and the role of the investment banker is to determine just how much that company is worth on the open market.

This is determined by a few methods.

Where do current market comparables value the same type of company?

How do the growth prospects fit in for future value?

How strong is the narrative/story of the company?

This all gets thoroughly worked with by the company and then gets pitched during the roadshow to help determine what buyers are willing to pay.

So now let’s talk about the issues that help people like me bet on the downside.

Issues of a Mispriced Market

For the sake of examples, I’m going to use Robinhood throughout this post as I talk about my different points.

Too much money means a race to invest

Venture capitalists invested more than $675 billion in start-ups worldwide in 2021, doubling 2020′s previous all-time high. Despite the pandemic, the number of so-called “unicorns” continued to rise at a clip last year, with some 133 start-ups in the San Francisco Bay Area seeing their valuations climb to over $1 billion, followed by 69 in New York, 21 in Greater Boston, 20 in London, 16 in Bengaluru and 15 in Berlin.

There are signs that VC has changed all around. In recent months, deal sizes and valuations have spiked in hot deals; due diligence on startups has evaporated as investors compete to get into hot deals first; venture firms are investing much more than they normally do; there are hyper-fast follow-on rounds, and more non-traditional investors are backing early-stage startups.

Whatever the original motivation, the surge of investment is being made possible by cash that's flooding into the venture industry, a trend driven by low-interest rates, exuberance over unusually strong exits in 2020/2021 and in companies such as enterprise software firm Snowflake, and high valuations for late-stage companies, such as gaming company Roblox.

Lack of due diligence

With the fierce competition for top deals, the rigor of due diligence is declining. Startup deals used to entail days of calls and research at the seed round and weeks at Series A or later. Now seed deals can now be done in hours, and Series As within days.

The frenzy is especially focused on the hottest deals among top entrepreneurs or companies. It's a maxim among venture capitalists that each year there are 15 to 20 startups that will be massively successful, and those are the only companies that matter in driving investors' returns.

But this filters down to lower-quality deals. For example, companies that are not snapped up by top investors are then backed by newer investors who are trying to break into the industry. And they may be even less diligent than established firms. You can actually read about how Tiger Global has entered the VC world and rewriting the book on VC investing.

“There are a plethora of companies that may be fundamentally good companies but are just overvalued due to the way that venture capitalists value and invest in them.” - Apeira founder Natalie Hwang

VC dynamics

The problem with VCs is that it’s quite a guessing game to determine what a company is worth. Some of the biggest problems I’ve noticed while reading investor decks and articles is that many always highlight

a) What the company could do

b) How big the market is

c) The story that really makes you believe that it’s worth more

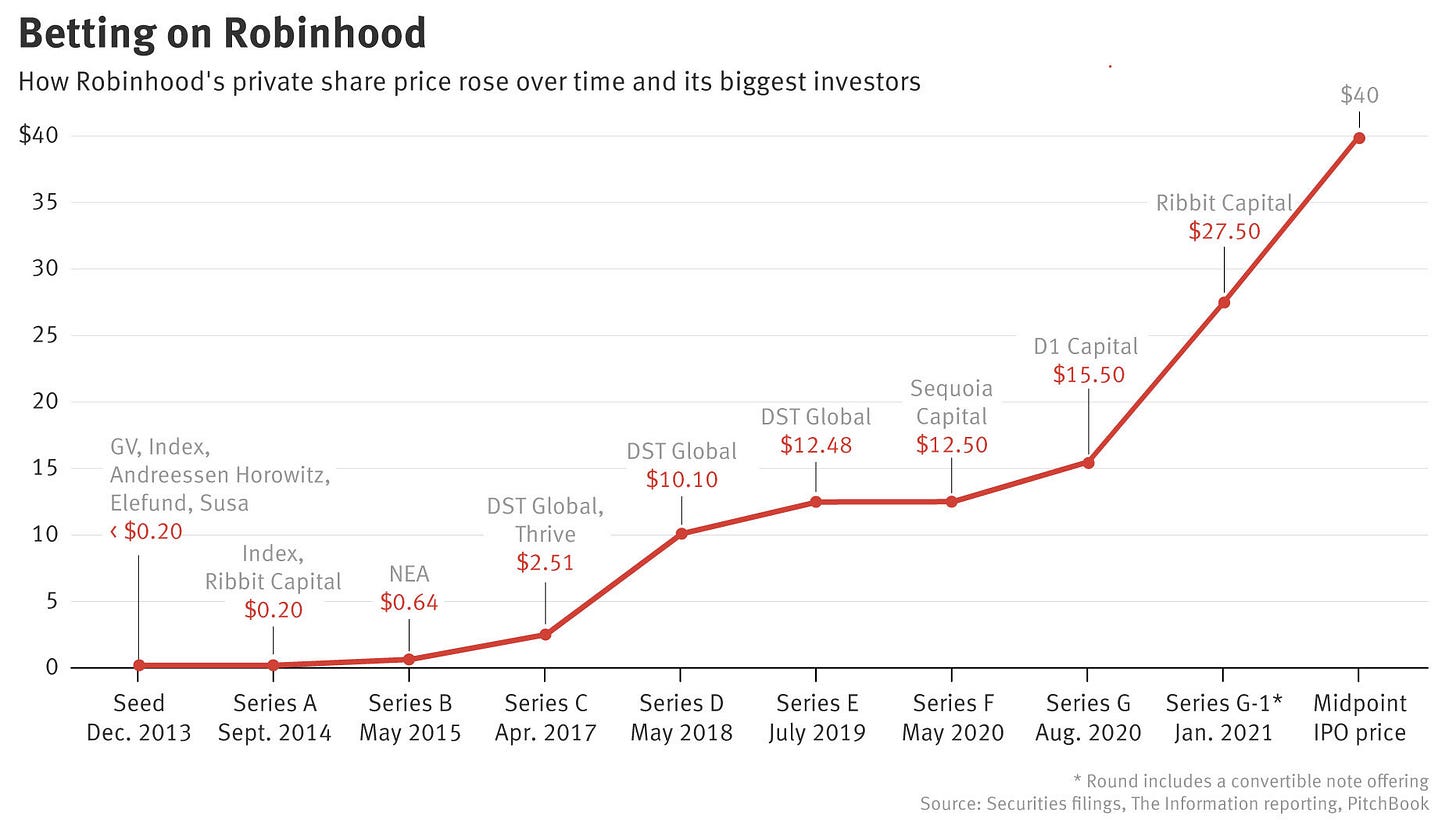

In terms of Robinhood, point A was a game-changer through the company’s move towards a no commission-based trading platform. This alone was inherently disruptive because historically, brokerages made money by charging investors a commission on each trade that they did. With no commissions being charged anymore, VCs believed that Robinhood could create a “new normal” of how investing was being done and they would be at the forefront of it.

Point B was supported by point A because with a new game-changing way of how business is done, more might be enticed to switch over to the platform to take advantage of no commission fees which means a bigger TAM.

With points A and B supporting the underlying company, point C is what helped investors bid up the valuation to sky-high levels. Robinhood’s whole creed was “democratizing finance” for all. They developed a simple to use platform via an app that had a great UI and UX, catered to those that felt intimidated to use legacy brokerages and investors bought into the story and wanted to fund its growth.

As we can see from the chart above, this all helped push the share price of the company to new highs, reaching $30b (based on a convertible note cap) in January 2021 after the whole GameStop fiasco.

What’s also to note, and not necessarily in Robinhood’s case, is that a private company having a down round (raising money at a valuation less than it previously had) is the red flag of red flags. This VC principle of making sure your company doesn’t get marked down is incredibly important and definitely plays a role in how VCs “invest up” or even at the same valuation rather than buy-in at a lower price. If a company has a down round, this really negatively highlights what’s going on in the company.

This helps push the narrative that the company is indeed worth more than it might actually be because of all the factors listed above.

Investment Bankers

The bankers help bring the investment home with the IPO. As a past investment banker, we really focused on the comps and the story. So how does this create issues? Honestly, we would say anything we had to in order to get a favorable valuation for IPO, within legal parameters.

Our job was to convince you that this company is a great one to buy into for the IPO and since it’s now tradeable on the public markets, you get all the presumed premium that goes along with that.

Investment bankers can twist valuations based on the comp set that they use, how they highlight the story of the company, its technology, anything they could possibly use that says, “hey, this company is doing things and going places and this is why you should get in now.”

Why investors believe them

At its core, investors really want to believe that a company can be much bigger than it currently is. People don’t want to miss out on the next Amazon or Apple because they looked too much at the underlying health of the business.

For Robinhood, the story of its disruption and adoption of retail investors really helped push the desire to be a part of something bigger. When demand for a company's stock is favorable, it's always possible that the hype around a company's offerings will overshadow its fundamentals. This creates a favorable situation for the company raising capital, but not for the investors who are buying shares.

This situation usually comes too late for investors that bought into the hype/story and then suffer massive losses, as you can see from above.

Quick note: traditional IPOs don’t allow for the company to talk about projections, SPACs, however, allow the company to highlight projections as part of the process of going public.

Top reasons for the disconnect relative and intrinsic value

Story → investors buying into what it can be and not what it currently is (market penetration)

Growth → too much attention to what growth has happened and thinking it can continue (justifying a higher multiple)

Technology → applying a premium for what “differentiating tech” they might have (presumed moat)

Below I’ll list my key takeaways for each short that I’ve had and what the market thought instead.

Takeaways

VCs valuing companies on the private market is a facade and investment bankers’ only job is (hopefully) to step up the valuation and see what they can get based on investor interest post them pitching them the story.

Public markets are not brutal. Private marks are a facade.Honest Co. went public in May 2021. It raised $412.8M that day (and $900M total). Shares closed on its first trading day at $23, giving it a valuation of $2.7B. Since that day, it has lost ~$2B and is now worth <$800M. Public markets are brutal. Be careful if you're IPO'ing.

Public markets are not brutal. Private marks are a facade.Honest Co. went public in May 2021. It raised $412.8M that day (and $900M total). Shares closed on its first trading day at $23, giving it a valuation of $2.7B. Since that day, it has lost ~$2B and is now worth <$800M. Public markets are brutal. Be careful if you're IPO'ing. Moiz Ali @moizali

Moiz Ali @moizaliVCs pump the valuation → investment bankers help legitimize it → public markets inevitably help validate it.

As an investor, you need to understand the actual “value” of a company based on what it has done, is doing, and the story that helps convince you of where it’s going.

A story doesn’t pay investors, earnings do.

Don’t go into the start of a research process with blinders on. Pressure test your original thesis on what could be wrong with it. When it came to my initial DD of FIGS FIGS 0.00%↑, I was long as everyone kept thinking it was the next LULU 0.00%↑. I then realized that I only saw good things about the company and nothing negative. This forced me to then look at what others might be missing and walla! I went short.

Bottom line

As long as VCs are flush with cash and a mandate to deploy it, valuations will continue to be sky high (in some respect) and when they go public with the help of bankers, it’s people like me that can step in and make money on the overhyped stories and flawed valuations.

Case in point, Robinhood.

Until next time,

Cedar Grove Capital