🍅 AppHarvest: Garden of Eden, Just Not Yet

AppHarvest is helping to tackle the world's food shortage but when price greatly exceeds the current potential, the stock is bound to fall back to the roots

Summary

AppHarvest is one of many companies looking to plant their feet in the vertical farming space to help combat food shortages and prove that indoor farming can be a worthwhile venture

Price competition is fierce and though the produce has many benefits of being grown indoors, it’s still considered a premium product with many consumers still very price-conscious

Revenue is slightly optimistic given many aspects can go wrong during the construction of its facilities and securing contracts and purchase orders for its vegetables

Business Overview

AppHarvest APPH 0.00%↑ announced it was going public via SPAC at the beginning of February, valuing the company at more than $1bn dollars.

The company specializes in building its own indoor farms to grow vegetables in the Kentucky Appalachian area as part of its take on the vertical farming revolution.

It has one operational facility in Morehead, KY that can host 720,000 plants and has already broken ground on two additional facilities in Richmond, KY, and Berea, KY.

The Morehead facility has been growing tomatoes and Richmond plans to grow vine crops on 60+ acres of land while Berea plans to grow leafy greens on 15 acres.

AppHarvest has plans for 6 additional facilities, all to be completed at various points by Q4 of 2024.

They have a partnership with Mastronardi, one of the largest producers and distributors of greenhouse-grown produce, who plans to sell all of AppHarvest’s produce to its national list of retailers.

This list includes names such as Walmart, Publix, Costco, Kroger, Target, and Whole Foods to name a few.

Investment Thesis - SHORT

I am the biggest fan of vertical farming. I honestly won’t shut up about its potential though I’m sure my friends would love me too.

I’ve already pitched two other companies Agrify AGFY 0.00%↑ (seller of physically growing units and data insights as a service) for their heavy equipment and also Hydrofarm HYFM 0.00%↑ (seller of growing products like equipment, fertilizers, etc. - read here) as a pick and shovel play.

AppHarvest is the pure-play vertical farm. They don’t grow anything other than consumable food. This company does not cater to cannabis companies, cannabis enthusiasts, or anything of the sort. They truly are an indoor farm.

With this being said though, the stock has received much fanfare and is priced way too high given its future projections of everything working out according to plan.

Given that it is indeed a farm, it should be priced more like one instead of a tech company. Let’s be real, just like I called out The Honest Co. for selling diapers, these guys are quite literally selling tomatoes.

The Good

To not appear biased, I want to make sure I highlight all the good things going for the company, which there are many.

ESG play

One of the best things about vertical farming is that there are a lot of environmental advantages to its business model. You don’t have to use pesticides or other harmful chemicals to keep plants from being destroyed, you use less water than traditional farming, and depending on the type of greenhouse, you can offset energy usage via direct sunlight or with green energy.

One of the most exciting aspects of where they decided to build their facilities is that they are strategically positioned to be within one day’s drive from 70% of the U.S. population. That means that they can cut down on fuel costs and effectively, their carbon footprint.

On top of this, they can achieve yields of ~30x that of open-field agriculture. Meaning, that all else being equal, the company can get more produce with the same amount of resources.

Partnerships and future facilities lined up

Like I mentioned previously, the company has a partnership with Mastronardi to distribute its produce to various retail outlets across the country. These are big-name companies that have a wide retail footprint that should be able to contribute to AppHarvest’s topline projections.

As of their most recent quarter, the company mentioned in its earnings presentation that they are now shipping truckloads directly to Kroger and Wendy’s.

What’s also a plus, is that they have broken ground on two facilities, have another six planned by the end of 2024 with a goal to have twelve facilities by the end of 2025. Given that the company really only increases its revenue based on how much it can produce, which in theory is capped, it will need to fund more farms in order to grow.

The Bad

Pricing power is a problem

Indoor farming has a lot of benefits, one of them tasting different because of how they are grown in a controlled environment and lack pesticides so their cellular structure is not altered. Most vegetables that are treated with pesticides have to be washed 3x before they are packaged and sold at grocery stores.

Because indoor vertical farming is at the point that solar cells were 30 years ago, it’s not quite price competitive right now, meaning you’ll be paying a premium for arguably a very similar product.

In the most recent quarter, management said they sold 3.8m lbs of tomatoes for $2.5m. If you’re analyzing price per pound, that’s about $.68 a pound wholesale. According to the USDA website for price spreads between farmers and retailers, in 2019, a pound of tomatoes was sold by farmers to retailers for $.48 a lb (this figure accounts for 15% of crop lost to spoilage or trimmage).

This means, on average, the retailer is paying ~38% more at wholesale than traditional outdoor farmers. Grocery stores rely on margins, sometimes razor-thin depending on the product but at these levels, it’s hard to convince the everyday American to buy a premium product just because of how it was farmed.

I am bullish that prices will eventually come down, e.g. solar cells, but that will be years down the road until economies of scale can really kick in and drive down costs.

Because of this, I’m hesitant to believe that many of the retailers that Mastronardi works with would buy enough from AppHarvest to make it worthwhile.

Skeptical of the financials

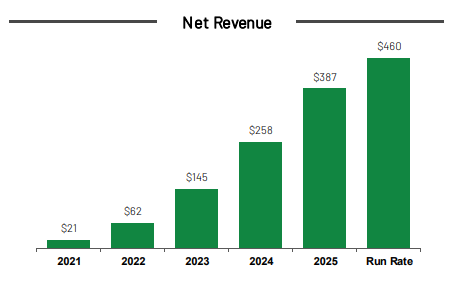

The company has its revenue growing at a 107% CAGR from 2021 through 2025 which is impressive and usually only seen by high-growth tech companies.

Though AppHarvest has reiterated its full-year revenue forecast for 2021 (mentioning falling between $20 - $25m) I’m skeptical that these figures tell the whole story. On paper at least, the unit economics of these farms look like they just print money, as shown in the waterfall chart below.

However, this doesn’t account for a few things that could hinder it - one of which I’ve already mentioned.

Given its premium price compared to outdoor-grown vegetables, retailers might treat it as a premium product and not buy enough to support the sales projections that the company is alluding to because shoppers aren’t inclined to spend more out of pocket.

Things go wrong and delays are a real possibility. These revenue projections point to everything going exactly to plan and not accounting for say, projects being delayed, accidental contamination of plants, power outages that occur, etc. It’s foolish to believe that a farm, though indoor, will not be met with growing pains on a facility-by-facility basis.

Unit economics could be negatively affected by the weather. Appharvest uses a combination of glass and LED lighting to power its facility and grow its plants. Though the sun is a very powerful and very free-ish mechanism to capture energy, it’s also not always available. Supplemental power to fuel the LED lights will be needed and should the price of electricity rise in a given year, this could eat into the 4-wall EBITDA margin predictions that the company has outlined - they even label this a risk in its SEC reports.

Not solving world hunger anytime soon

Global food security is one of the main threats we face in today’s world. Genuine food security means that when the ice road is closed, or the airplane can’t fly, the community can still feed itself the staple foods needed for survival and basic health. The vast majority of these systems produce only vegetables, and especially low-calorie vegetables like lettuce, kale, chard, spinach, herbs, etc. because most of those plants’ weight can be sold and eaten.

Human beings cannot survive on these types of foods.

If potatoes, tomatoes, or green beans were being grown, much precious building space and costly electricity would go into producing inedible leaves, stems, and roots. So if you think vertical farming will provide us with food security then think again or maybe start taking basil for breakfast, lettuce for lunch, and spinach for dinner.

Valuation

While the technology is very interesting and the company’s ESG play fits into a lot of portfolios that have an ESG focus. However, at the end of the day, at its base root, it’s a farm. A farm that currently grows beefsteak and on the vine tomatoes. They have plans to grow leafy greens and peppers. This does not scream “high multiple business”, especially when the only way they can scale is with the buildout of more facilities.

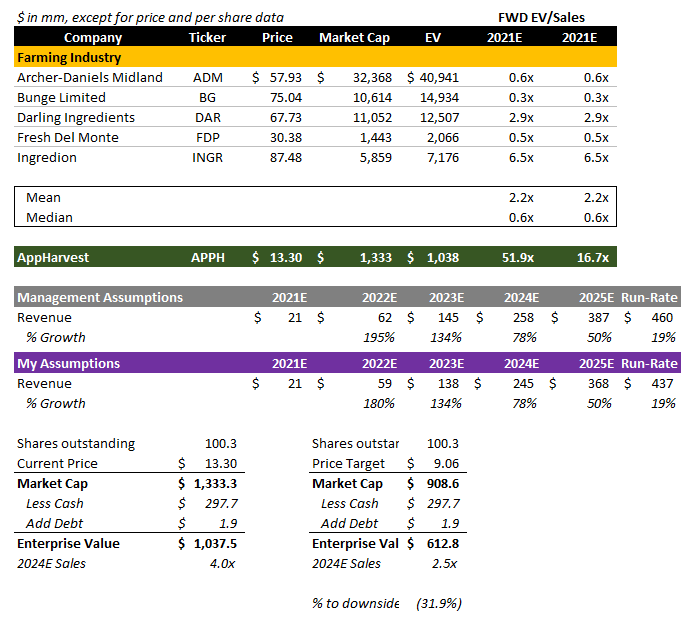

Though there are ways to cut costs and boost operating leverage (e.g. rent, labor, energy costs), we need to base it on the assumptions that they should be trading alongside other farming-related companies.

Based on the investor presentation that took AppHarvest public, they valued the company on a proforma basis of $570M in enterprise value and $1bn in market cap. This gave them a 2.2x EV/Sales multiple for 2024E (which I hate projecting that far for what was a pre-revenue company) and a 9.3x adjusted EBITDA multiple.

My analysis

For my analysis, I wanted to compare AppHarvest to other peers in the farming space. Though these players are more mature and their growth rates have slowed down I still wanted to have as best as I could to a pureplay comp but base assumptions on 2024E sales, similar to that of the investor presentation.

As you can see, these farm-related companies trade at very low forward multiples that are a direct result of slow growth within the industry. Though AppHarvest is projected to have fast growth as they ramp up its facilities, growth tapers off at a run rate that is just a 19% jump from the previous year and should continue to taper off unless more facilities are built.

I did feel that management’s revenue expectations were slightly aggressive only because I believe things will go wrong (as I mentioned above). I factored in a modest 5% haircut to sales starting in 2022 onward. This led me to a 2024E sales figure of $245m vs. $258m and with the select comps, a 2.5x multiple compared to their original 2.2x. mainly because of the growth that can be achieved with new farms.

Very much in line with what the initial merger value was based on though cash has gone down to fund operations and build the two new facilities in Richmond and Berea (expected CAPEX of $145m - $155m to build those two).

This all yielded a price of $9.06, a ~32% downside from current levels. However, because of the hype and FOMO of retail investors looking to be in this sector, I would not imagine seeing the company trading that low (52-week low currently $9.80) but could retrace back down to $10 (~25% downside) as more updates around facilities gets released and the lock-up period expires.

Conclusion

At the end of the day though, this is a farm that sells tomatoes. Nothing sexy about it besides how it’s done. A very capital-intensive business that needs funds to grow, operate, and scale. Margin pressure will exist in the short term as the company figures out how to scale with minimal issues and can be alleviated by raising capital in non-dilutive ways, as mentioned in its more recent earnings.

I’m all for the company and for vertical farming, just not at these levels. Once the company can come down a bit, I would definitely hold a LONG position on the stock, but only then.

*The current stock price at the time of this article: $13.30.