Agrify - The "Little" Vertical Farm That Could

2020 earnings release shows impressive growth and a promising future for this small-cap indoor farming player

Summary

Agrify posted exponential growth in 2020 from a year ago and shows no sign of slowing down

Promising news and results in their Agrify Insights business segment will help contribute to consistent recurring revenue with minimal churn

Their valuation is not entirely out of whack given their growth prospects and forward sales estimates

Business Overview

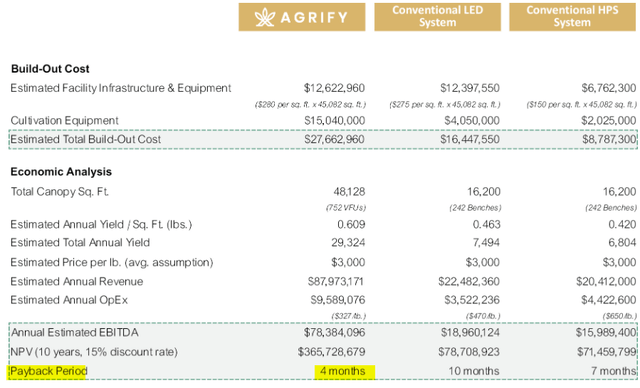

Agrify Corp AGFY 0.00%↑ commercializes a high-tech indoor agricultural system primarily targeted at the cannabis market. The company's Agrify Vertical Farming Unit "AVFU" is a micro-climate controlled module that is stacked to maximize indoor cultivation space. The key advantage over traditional lighting-based grow facilities is an integrated software solution known as "Agrify Insights" which allows for precision environmental controls and process automation that adds efficiencies to maximize yields.

Earnings Recap - 2020 Highlights

Agrify reported its fiscal 2020 Q4 results on April 1st with a negative income of -$13.1 million on $4.35 million in sales

The wider net loss compared to Q4 2019 was driven in part by the higher spending and investments to fund the company's expansion

More favorably, sales increased 161% y/y in Q4 and 196% for the full-year 2020.

Began realizing higher-margin SaaS revenue as customers commenced operations utilizing the Agrify Insights™ software solution

Completed the development of and started taking pre-orders for the newest generation of Agrify's Vertical Farming Units (“VFUs”), which offer improved lighting efficiency, greater light output, and a wider range of environmental control and reproduction, furthering the Company's mission to deliver consistency to the industry

Acquired TriGrow Systems, Inc., which was the exclusive distributor of Agrify’s indoor grow solutions, giving Agrify full control of sales, product marketing, and customer relationships

Acquired Harbor Mountain Holdings, LLC (“HMH”), an agile manufacturer and installer of many of Agrify’s products, giving Agrify direct access to HMH’s research and development, testing, and flexible manufacturing plant located just outside Atlanta, GA, along with key engineering talent and equipment

New Developments

Turn-key Solutions

Agrify is launching a new program known as "Agrify TTK", a turn-key solution that packages the hardware and software with a partnership arrangement. For qualified customers, Agrify will lease the equipment along with arranging capital to fund new cultivation ventures with hands-on consulting and training. Customers would ultimately repay the construction loans along with a portion of the revenue stream. Management is targeting an internal rate of return between 40-50% initially aimed at markets that have more favorable wholesale pricing and regulatory conditions. Overall, this adds to the bullish tailwind for the stock in addition to core sales.

“As we look towards 2021, we note that we have already made progress on a number of key initiatives, including launching our Agrify TTK Solution, the industry's first total turn-key solution. Through this program, we aim to help our customers by providing them with access to capital, leading-edge technology, and the industry expertise they need to consistently cultivate high-quality products. This should enable our customers to get to market faster, with consistent, high-quality products that are grown in a controlled and replicable environment, all at a lower cost of production. “ - Raymond Chang, CEO

WhiteCloud Botanicals

On April 5th, Agrify announced a receipt of a $3.5M purchase contract, expanding their relationship with WhiteCloud Botanicals. This purchase order includes new phases of facility design and build-out as well as 132 more of Agrify’s Vertical Farming Units (“VFUs”). Additionally, the agreement will include three years of recurring SaaS revenue for use of the Agrify Insights™ software platform. The initial build-out process is expected to commence in April 2021, with a target for completion in Q4 2021.

“Since implementing the Agrify indoor grow solution, our products have been in high demand, and their double-stacked VFUs enable us to significantly increase cultivation capacity compared to traditional single-tier grow rooms. Accordingly, we have been able to increase our flower production output without expanding our overall facility footprint. Agrify is a partner that we have had the good fortune of working hand-in-hand with to improve cultivation. They have also served as a valuable sounding board for us on our branding, marketing, and distribution strategies, and we look forward to continuing our successful relationship.” - Nick Lynch, Owner and Founding Partner of WhiteCloud

Forward Estimates and Valuation

According to consensus estimates, Agrify is forecast to reach $37.5 million in 2021 which represents a 210% increase compared to the 2020 results. The momentum is expected to continue through 2022 with the current estimate of revenues at $69.5 million next year, another 85% annual increase. While the company is not expected to be profitable during this high-growth phase, the net income loss and negative EPS should narrow through fiscal 2022.

In terms of valuation, the metrics I’m looking at show a relatively modest 1-year forward price to sales multiple of 3.5x. Again, this is in the context of 210% revenue growth this year and 85% for 2022. In this case, Agrify benefits from a low comparable base and the timing of the new product launches that are set to drive growth.

Why I Still Like the Stock

Agrify is a small-cap stock with a current market cap of roughly $240M. I don’t really invest in small-cap stocks but this company caught my eye ever since I caught wind of it going public in December. If you missed my initial article on them after they went public for a more in-depth breakdown, click here. Though Agrify is a small company, investing in them is an opportunity to get in on the ground floor with an infant company that’s going to be riding incredibly strong tailwinds in the indoor farming industry.

A few points to call out:

They have multiple avenues of growth from selling their actual VFU’s (vertical farming units), providing their SaaS (Agrify Insights) to build recurring revenue, buildouts of growing facilities, and offering their expertise through their consulting services.

They can achieve a net present value that is ~5x higher than a facility using conventional LED or conventional high-pressure-sodium lamps with an overall backpack period of just 4 months.

(Macro) Further legalization of cannabis across the United States will continue to open up new whitespace for the company to expand its footprint and build out further client relationships.

(Macro) Indoor farming is growing quickly in urban environments and with space being incredibly limited, the need to build out farms in small, compact places, such as metal shipping containers, will be ever-growing.

Agrify has raised enough capital ($147M) through their IPO and secondary offering back in February to sustain themselves during this growth phase for the next 4-5 years at this rate.

Even though the stock has been very volatile since IPOing, I am bullish on the stock going forward even more than I was back in February.

Analysts’ price target hover between $20 - $22 a share, a +76% upside from Friday’s close. With the stock hitting its peak in early February ($21.43), it’s not something that is too far out.

Bottom line, there is only so much space to grow crops horizontally in the world (in 2015, scientists reported that the Earth had lost a third of its arable lands over the previous 40 years), and with the world’s population expected to grow to 9.7 billion people by 2050, feeding it will be a huge challenge. Agrify is poised to capture this market opportunity for the long term.

I look forward to seeing where the stock goes next.

*The current stock price at the time of this article: $11.91.