A Few Updates and Two Pitches

Going over SHCO, LQDA, Capri (CPRI), Tile Shop (TSSH), and the FDA.

Preview

In the below post, I’m going to highlight

Additional context to our Soho House (SHCO) arb trade and why we’re short,

Updated context for the INSPIRE study for Yutrepia and why it’s incredibly bullish for the future of Liqudia (LQDA),

The special situation of Capri Holdings (CPRI) and what the value could unlock if they do divest Jimmy Choo and Versace,

A potential special situation with The Tile Shop (TTSH) where activism or a take-out could in the near horizon, and lastly,

Recent FDA notices around compounding Tirzepatide and what that could mean for the future of a Semaglutide resolution.

The below will be shared in that order so feel free to skip around if one pertains more to you than others.

To get our full list of research, click here to access our table of contents.

Cheers.

Soho House (SHCO) Take-Private

On December 29th, we shared our M&A arb note that we had a short position in Soho House (SHCO) intending to call their bluff on the take-private offer of $9/share announced after the bell on December 18th.

With so much limited information, we could only go on what the past had given us earlier in 2024 when they once again had an “offer” to go private but rebuked it because it was too low.

Mind you, at that time, the company just announced earnings on March 15th (Friday) and the stock sank ~14% from $5.75 to $4.97/share. Conveniently, the company announced they were in talks to get acquired on March 18th (Monday) and the stock popped 21% that day.

Even that is oddly suspicious considering the same thing just happened in December except instead of waiting over the weekend they announced it the same day as earnings.

We’re not allegedly stock manipulation or anything of the short but we’re just highlighting a trend here that seems suspect.

Besides that one callout, we also wanted to highlight that even after we rang in the new year and everyone came back from vacation and their holiday break, the market probability still hasn’t improved.

Since we published our short report on 12/29, the market probability has only improved by 70bps in ~2 weeks. The market is basically marking it as a coin toss even though there’s no regulation risk here.

This is purely execution risk and believing that a deal is a) actually on the table and, b) one that management would take.

We’ve already discussed this in the article above but we wanted to take a second to highlight the financial reason a step further than we did in our initial report.

While we highlighted that net leverage was considerably high (7.9x), we wanted to highlight what the deal mechanics could look like, making this deal even more improbable of being taken over.

As we mentioned before, if you combine Ron, Richard, and Nick’s equity stakes, that’s about ~74% of the total shares outstanding (~144 million). So if it’s just on them rolling their equity, there are arguably ~51 million shares that need to be bought in order to take the company private which doesn’t include any potential equity the buyer allegedly might have.

Assuming the buyer(s) hold no shares at the moment, this implies ~$454 million in equity that would need to be acquired to complete the deal @ $9/share.

What we put together is a table consisting of the annual payments that would need to be made on new debt taken on at various LTV’s and rates. For these calculations, we’re assuming a 7-year term on the debt, LTV’s ranging from 40% - 80%, and interest rates of SOFR + 250bps in increments of an additional 100bps (SOFR is currently at 4.29%).

This gets us to the below.

At SOFR + 550bps (8.79%) which we think is reasonable considering they have two senior secured notes at 8.5% and 8.1764%, we’re looking at ~$54 million in payments at a 60% LTV.

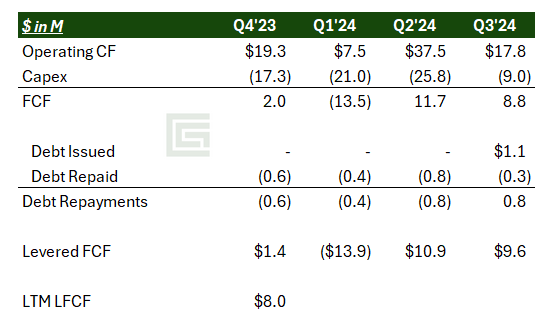

The reason this is a problem, any way you cut it, is because the company’s levered free cash flow (LFCF) was only $8 million in the last twelve months (LTM).

Also don’t forget that you are most likely going to need to roll the current debt over depending on what the plan is with the consortium.

Sure, you can also make the case that the company will save a few million by not being a public company but is that really worthwhile to pull yourself out of the public markets which Ron has stated in the past? Probably not.

With the additional decrease in FY EBITDA guidance to just $140 million ($21 million less than before), the company just can’t handle additional debt and it makes little to no sense for a company/fund/individual to want to put in more equity for a company that’s barely growing.

In LBO terms, it’s not like an investor is getting paid out here eventually with a dividend recap or an IPO until MUCH later down the road, if at all. The equity upside just doesn’t seem worthwhile.

So this leads us to believe a few options.

The offer is serious and potentially more equity rollover is needed (a few hundred bps) but still leaves the question of financing.

There is no realistic offer because the math ain’t mathing.

Given that the market probability has barely moved in two weeks with no risk for regulatory approval, we are inclined to think it’s more about option #2 rather than #1.

The return needed for a group to come together and buy out the company with a massive equity rollover just wouldn’t make sense. SHCO would need to double in size in just a few years to even remotely make those numbers start to work.

This is probably why they rejected the first offer earlier in 2024 because the numbers just couldn’t support it.

Recent Yutrepia Results are a Homerun for Liqudia (LQDA)

On January 7th, we published our long on Liquidia Corp (LQDA) and how their impending lawsuit against the FDA might allow them to sell their breakthrough Yuptrepia drug to treat PAH and PH-ILD could be worthwhile, and if not, that they’re still scheduled to launch in May.

Luckily for us, LQDA shared a presentation at the JPM Healthcare Conference last week which highlighted data from their INSPIRE and OLE study. You can find the full presentation below.

After insiders sold shares the day before, due to tax reasons and part of a 10b5-1 plan established in December of 2023, the stock has already rallied ~14% in just a few days.

Let’s go over a few points and why we’re more bullish on the stock after the release.